Ingrid Pan

Ingrid formerly worked at Bank of America Merrill Lynch, Five Rings Capital, Goldman Sachs, and Morgan Stanley.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ingrid Pan

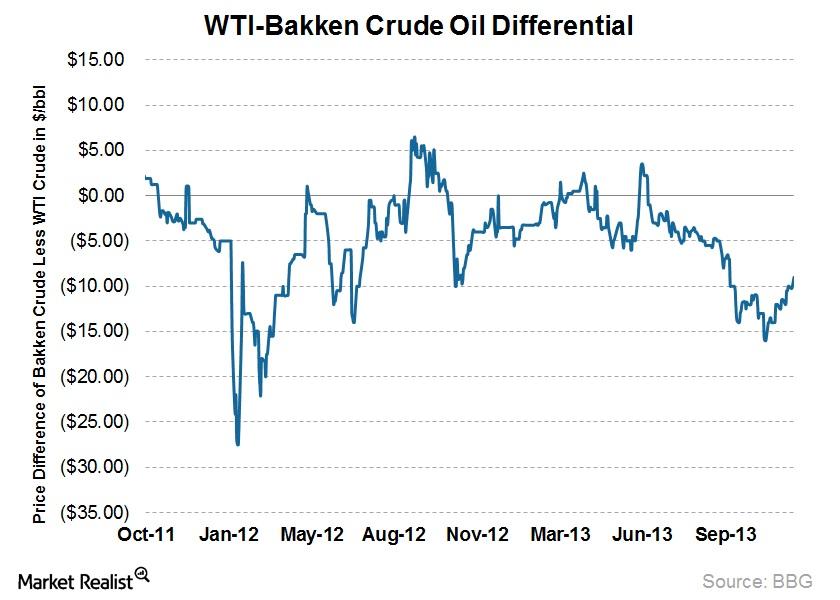

Why oil takeaway capacity in the Bakken can affect earnings

The availability of takeaway capacity from the Bakken can affect producers’ earnings.

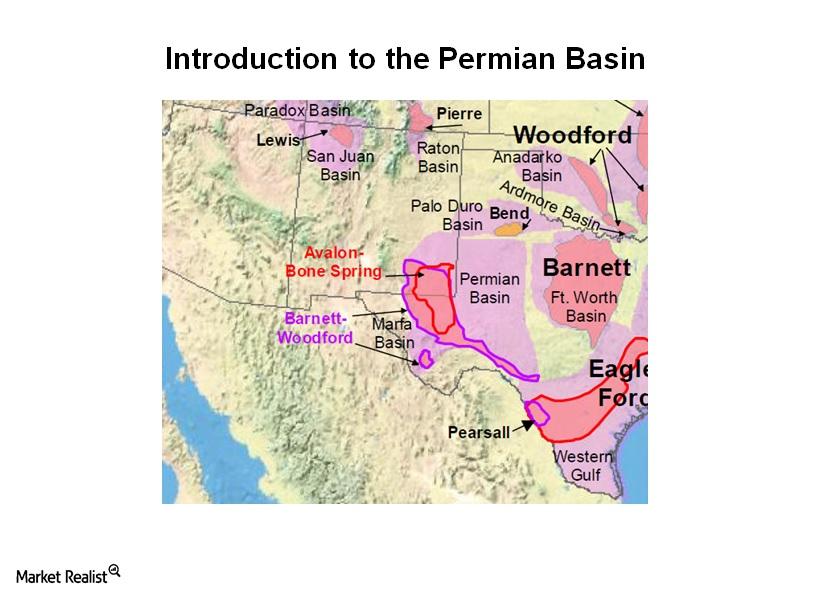

Introduction to the Permian Basin — Part 2: Geography of the Permian Basin

The Permian Basin is one of the US’s primary drivers of oil production growth. Market Realist provides an overview of this prolific hydrocarbon asset with a primer piece: “Introduction to the Permian Basin”.

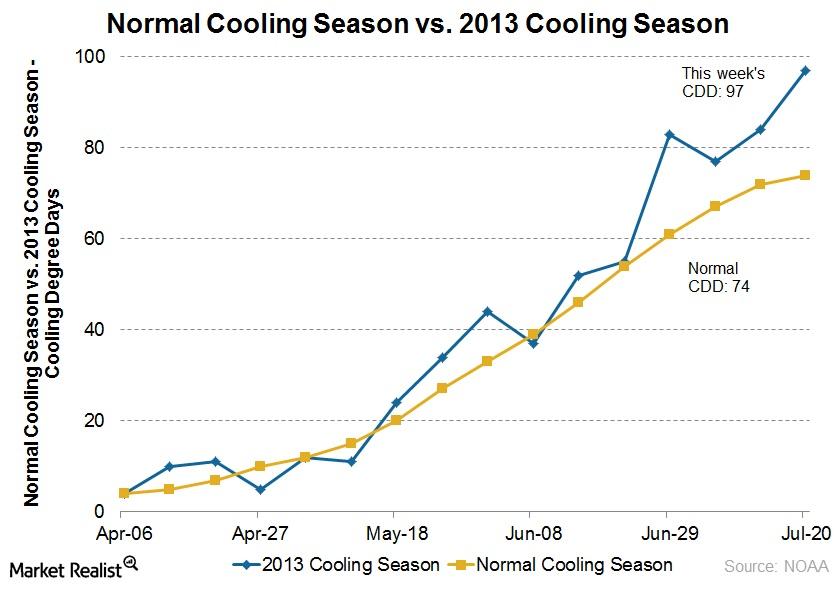

Why the summer heat wave supports natural gas prices

A heat wave that has persisted in the US has helped to lift natural gas prices.

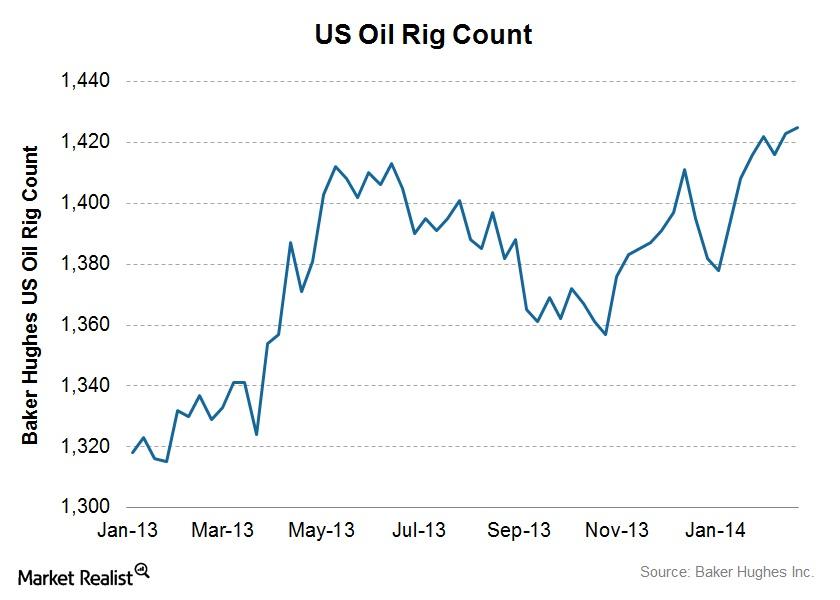

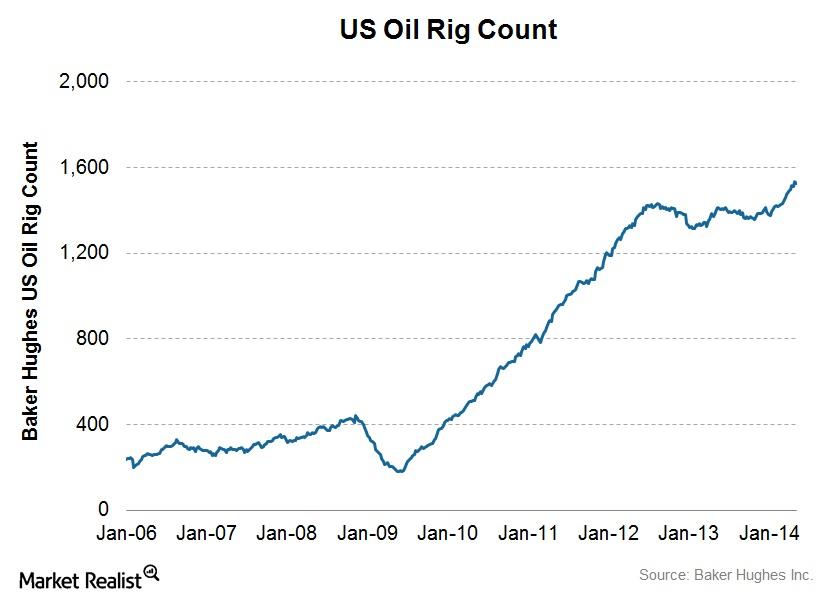

US oil rig counts continue to rally, reaching a year-to-date high

Last week, the Baker Hughes oil rig count increased from 1,423 to 1,425, reaching the highest level since 2014 began.

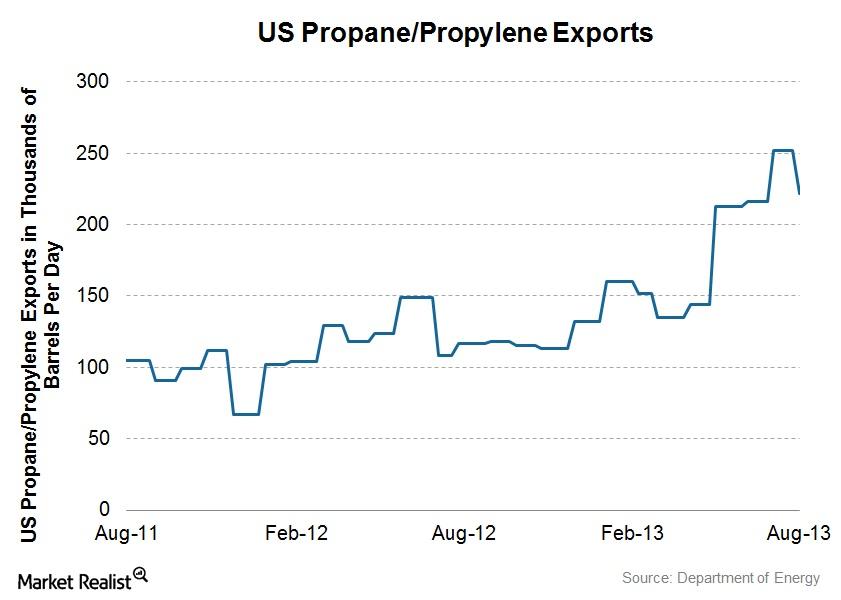

Why some MLPs are benefitting from increased propane exports

Significantly higher rates of propane exports have helped to boost propane prices—and the margins of some MLP names.

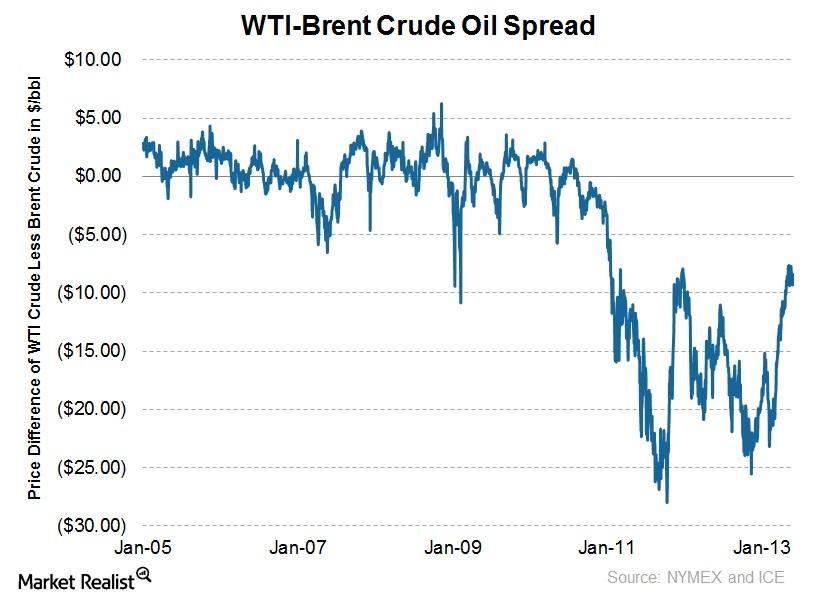

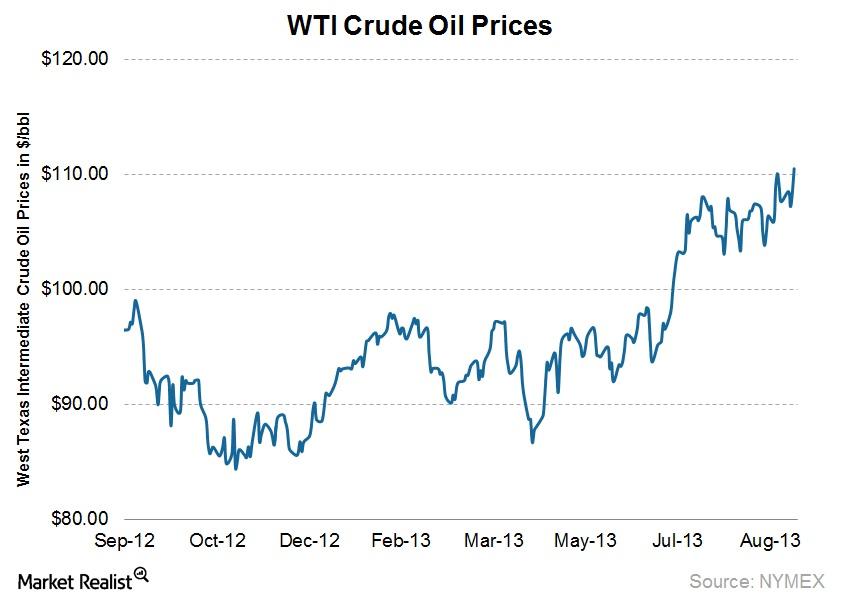

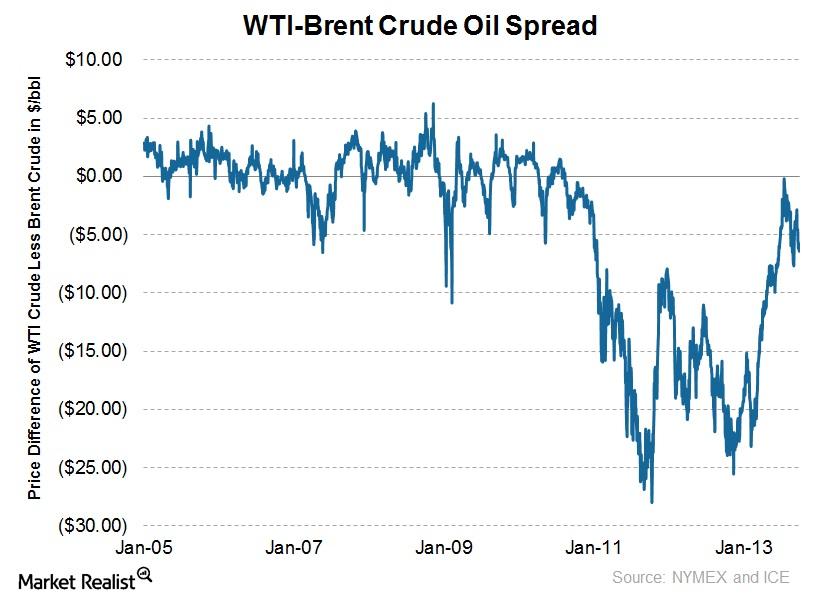

Spread between WTI crude oil and Brent oil has closed in significantly since YE2012

The WTI-Brent spread remained relatively unchanged last week, but has closed in significantly since year-end 2012.

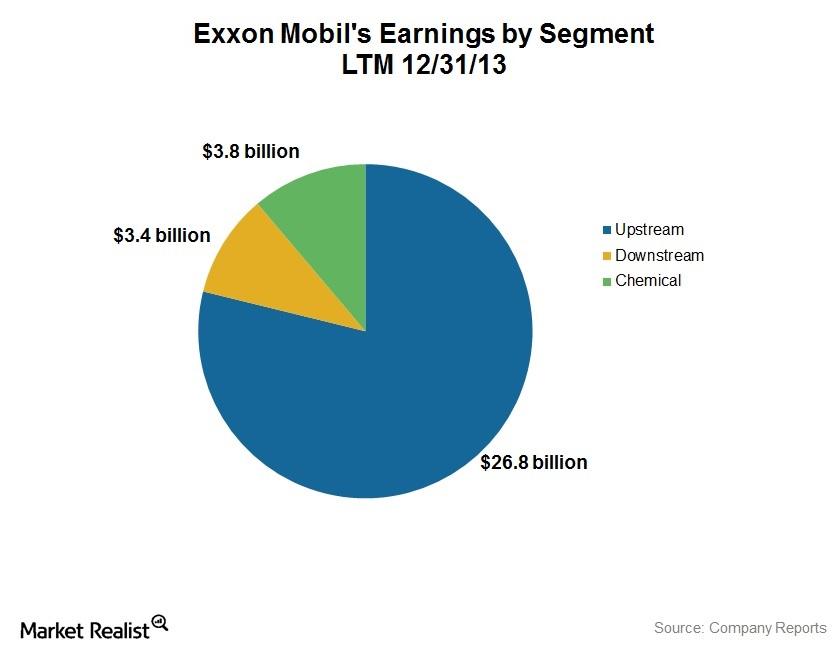

An essential guide to Exxon Mobil: XOM’s major areas of operation

Exxon Mobil has three major business segments: Upstream, Downstream, and Chemical. Upstream contributes the most to XOM’s earnings.

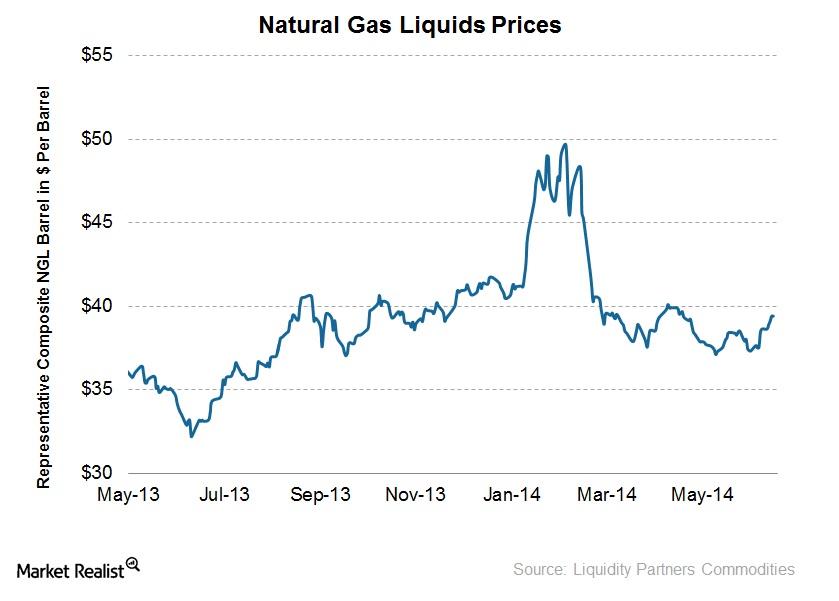

Natural gas liquids prices rise, boosted by propane prices

The representative NGL barrel reached highs of up to ~$50 per barrel in early February, given the strength in propane prices due to a cold winter as well as natural gas prices that pushed ethane prices up.

Must-know update: Why the US oil rigs are up over 10% year-to-date

US oil rigs drilling are up over 10% year-to-date, supported by oil prices that have remained relatively stable around the $100 per barrel mark.

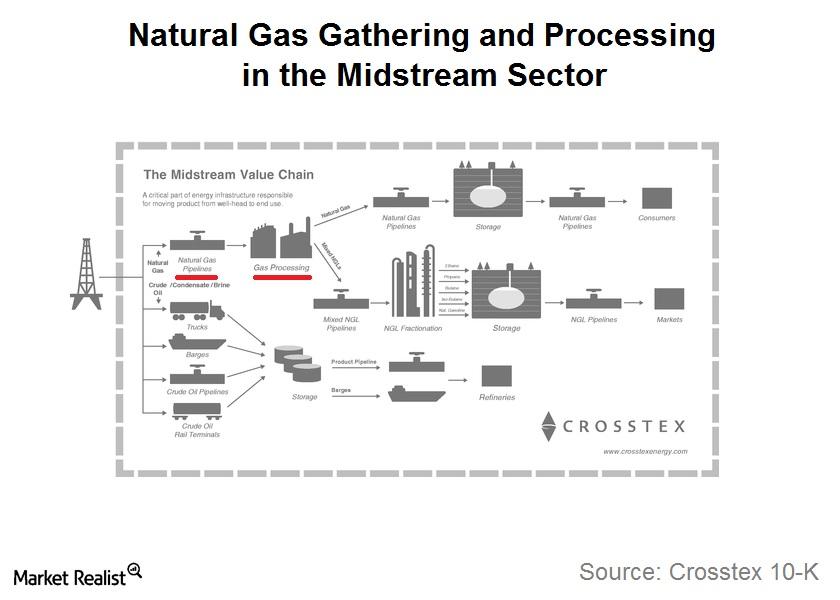

Why natural gas gathering and processing are important for MLPs

Natural gas gathering and processing is a significant part of the operations of many midstream master limited partnerships.

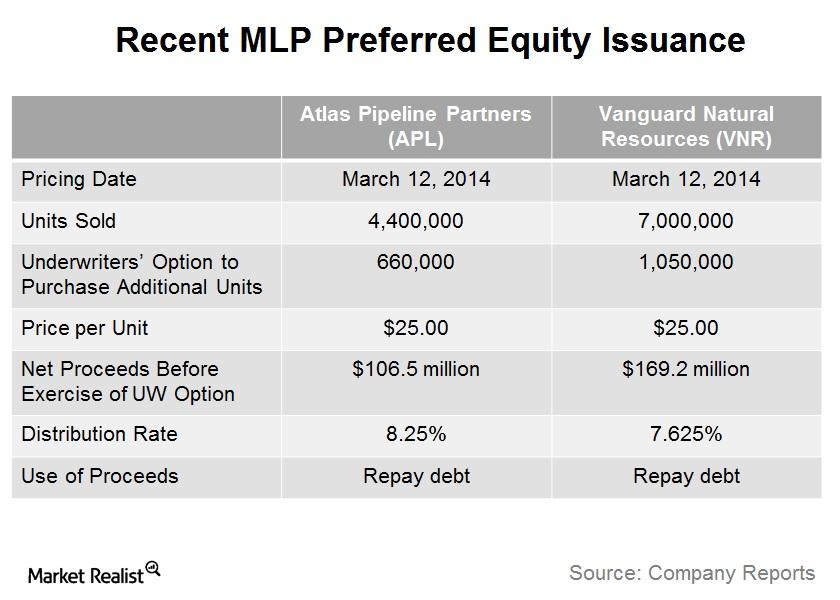

Is preferred equity a trend for master limited partnerships?

Recently, two master limited partnerships issued preferred equity, which is a relatively rare avenue of financing for MLPs.

Higher oil prices are a potential double whammy for propane sales

Propane distributors such as Amerigas Partners (APU), Ferrellgas (FGP), and Suburban Propane (SPH) sell propane and related equipment to a variety of end markets. Find out what trends could hurt propane names this winter.

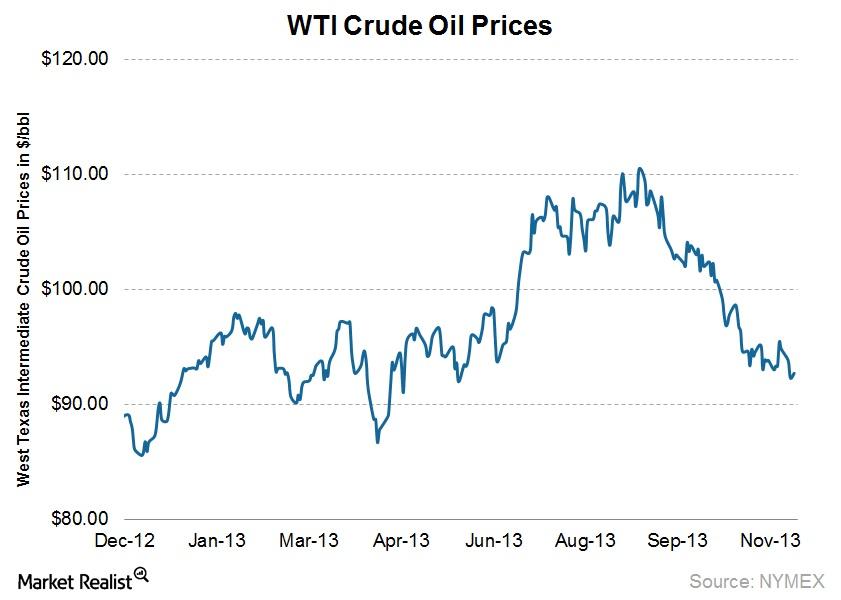

Why WTI crude oil prices are down over 15% in 3 months

WTI crude oil prices continued to slide as U.S. crude inventories continued to grow, with domestic production surging.

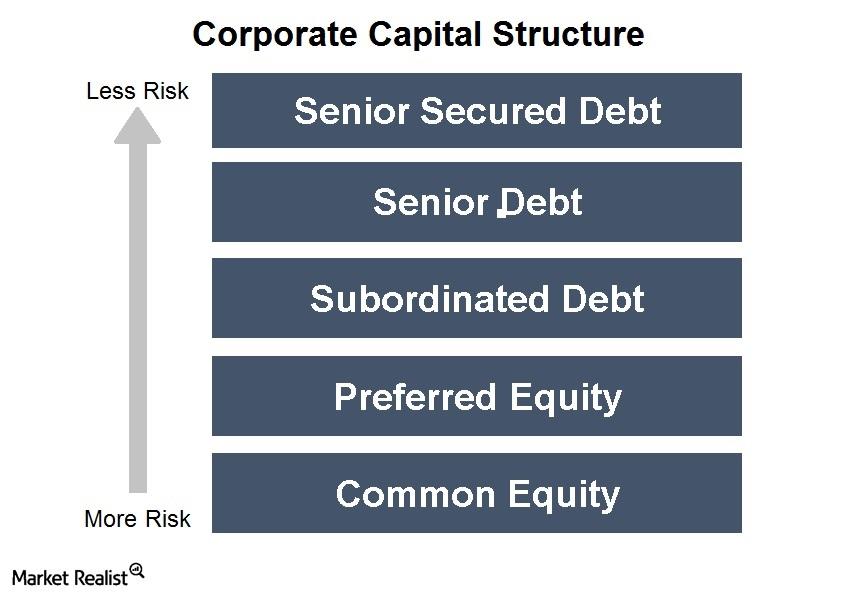

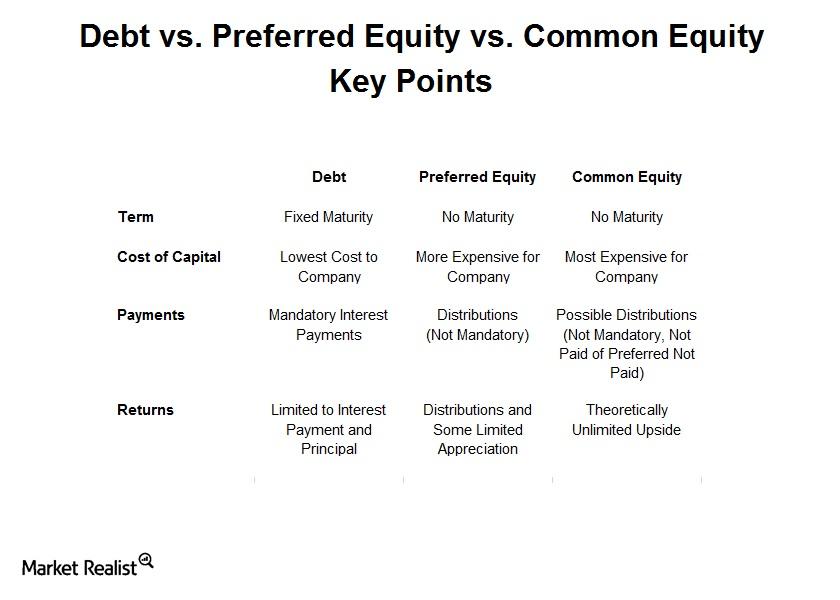

A guide to preferred equity and 2 MLPs that recently issued it

Preferred equity (also called “preferred stock”) is a class of security that has features of both common equity and debt. Preferred equity acts like stock.

Why some companies may “prefer” to issue preferred equity

Companies may prefer to raise money through preferred equity for a few reasons. One possible benefit to issuing preferred equity is to reach a new pocket of investors

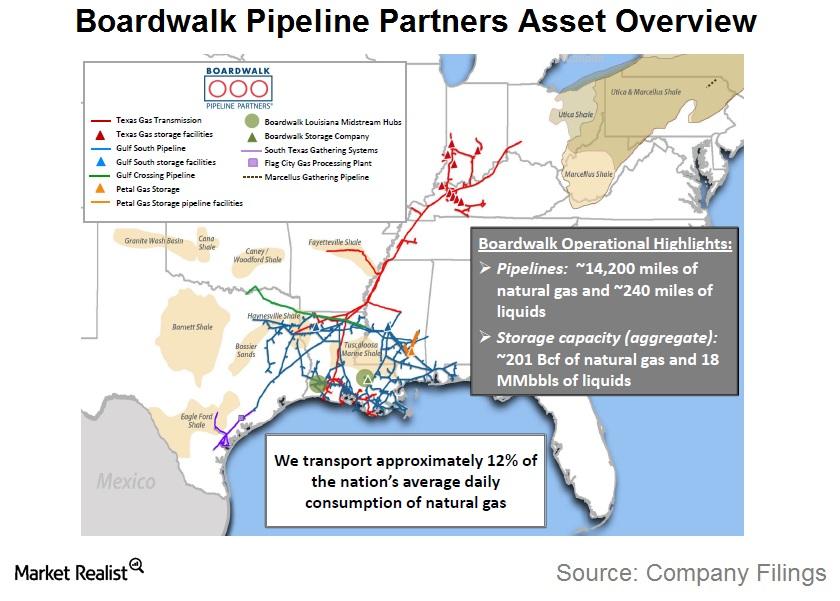

Boardwalk Pipeline Partners: An investor’s must-know overview

Boardwalk Pipeline Partners (BWP) is a master limited partnership that provides transportation, storage, gathering, and processing services for natural gas and natural gas liquids.

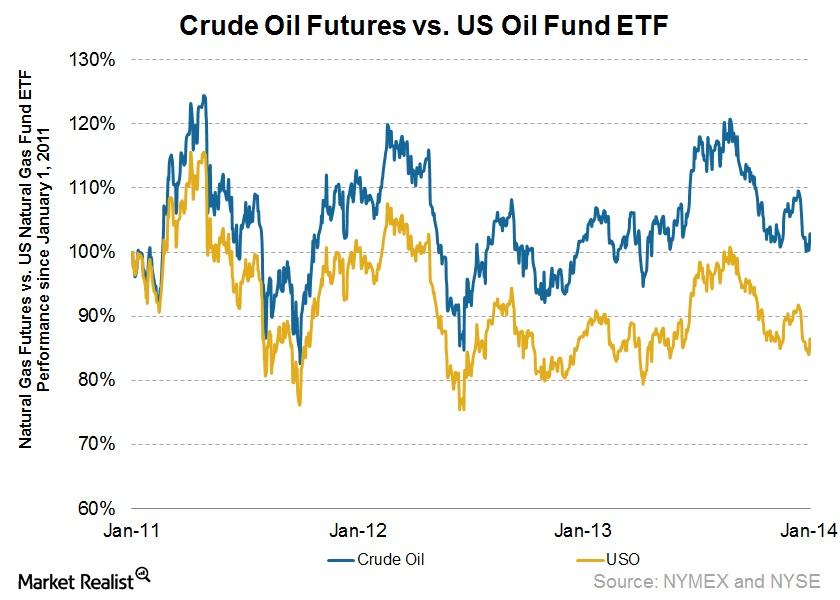

Recommendation: Should investors bet on an oil price drop?

Shorting crude oil ETFs or purchasing some inverse ETFs can provide exposure to downside movements in crude oil prices.

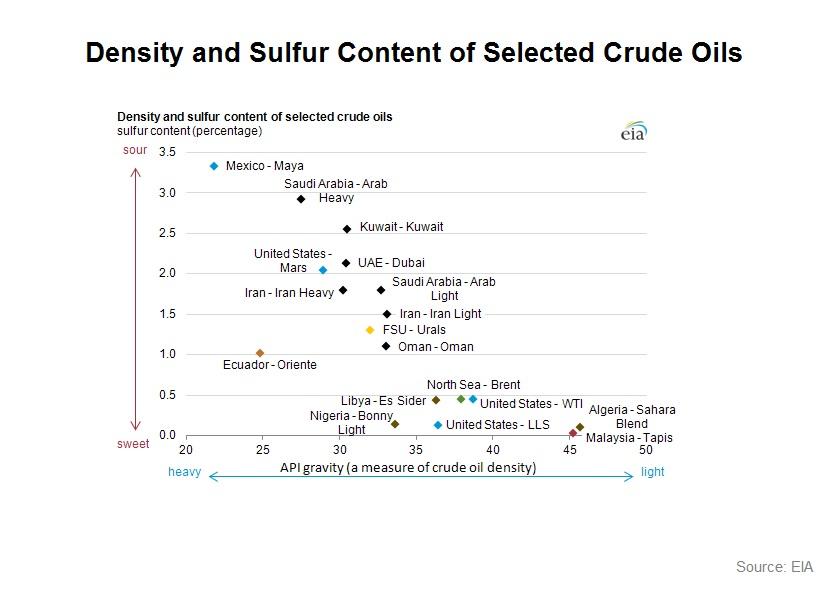

All oil is not created equal – why differences in crude matter (part II)

Differences in crude’s density, sulfur content, and production location can vastly affect the price which it commands on the market.

A key guide to Uber and the changing world of transportation

Uber is a San Francisco–based on-demand car service that’s accessed through a mobile phone application. Though it acts as a high-tech car service at the moment, its future could be enormous.

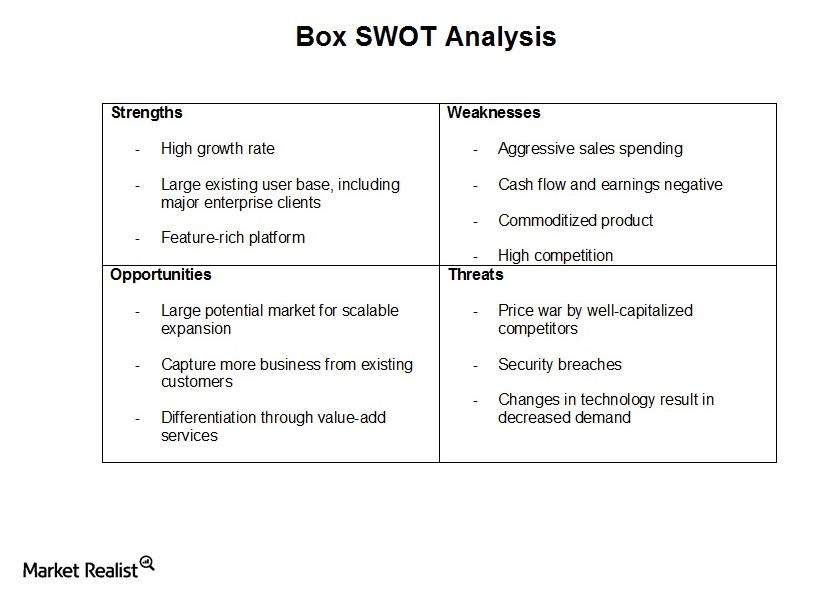

Must-know: An analysis of Box’s threats

Box was created due to changes in the way users store and collaborate on files.

Must-know: An analysis of Box’s weaknesses

There’s no shortage of companies offering services similar to what Box offers.

Must-know: Assessing Uber’s current competitive landscape

Uber’s close competitors in the space include Lyft (60+ cities, U.S. only) and Hailo (10+ cities, international), though the two have slightly different business models.

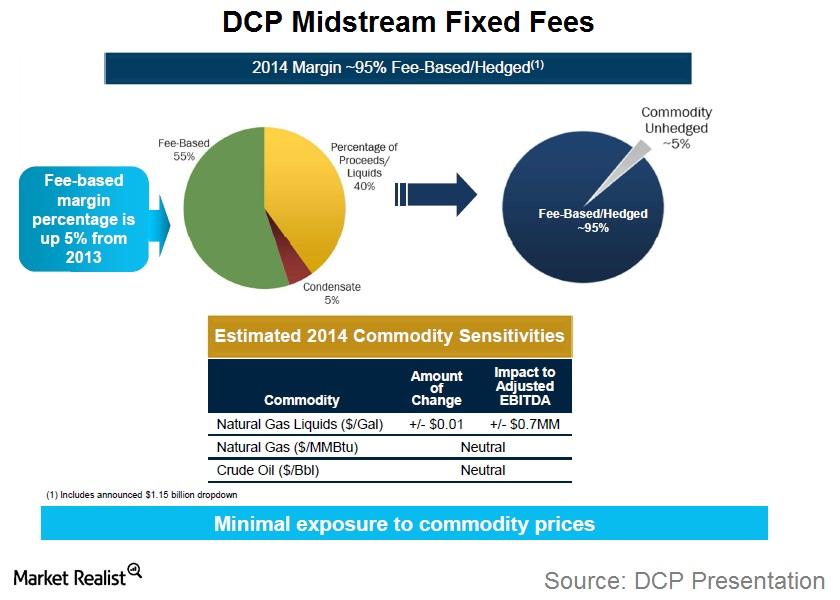

How MLPs profit from natural gas gathering and processing

Natural gas gathering and processing are a significant part of the operations of many midstream master limited partnerships.

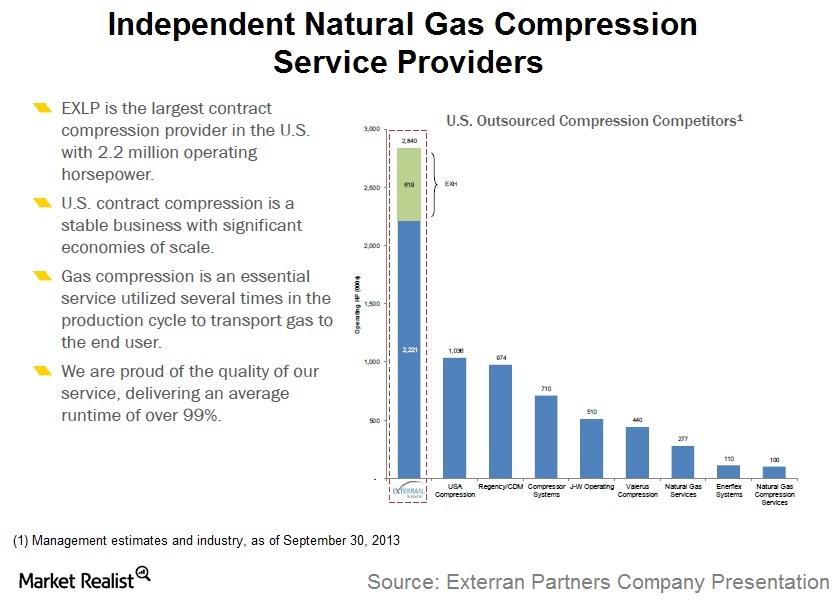

An overview of natural gas compression companies like Exterran

Natural gas compression services are used to transport natural gas. Compression is often used to get natural gas from low-pressure wells to gathering systems, and to maintain production as reservoir pressure declines.

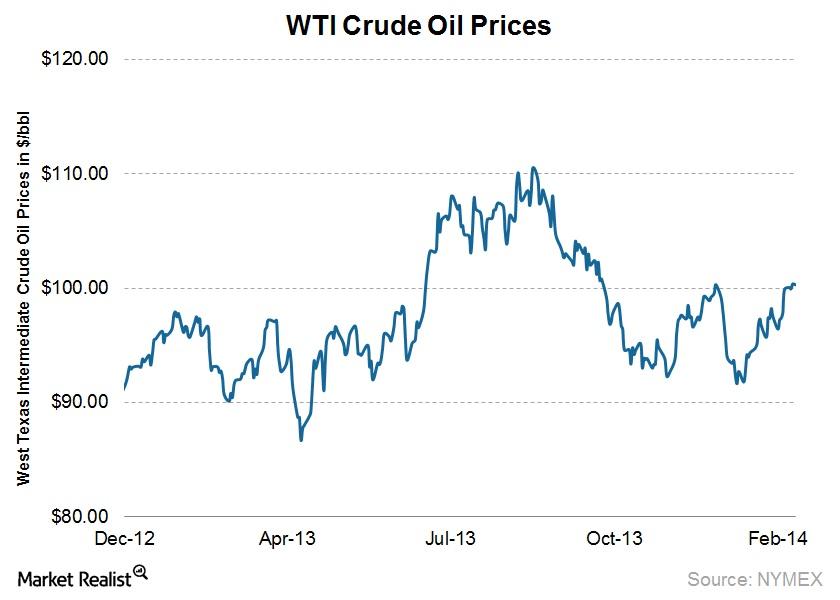

WTI crude prices break $100 per barrel for the 1st time in 2014

WTI traded flat last week, but firstly traded up $100 per barrel since December 27. This past week’s upward movement in prices was a short-term positive for the sector.

Why Twitter is like the cronut: It’s all about the hype

Twitter stock as appreciated rapidly since its recent IPO, but is it worth the price? Has hype inflated market prices beyond intrinsic values?

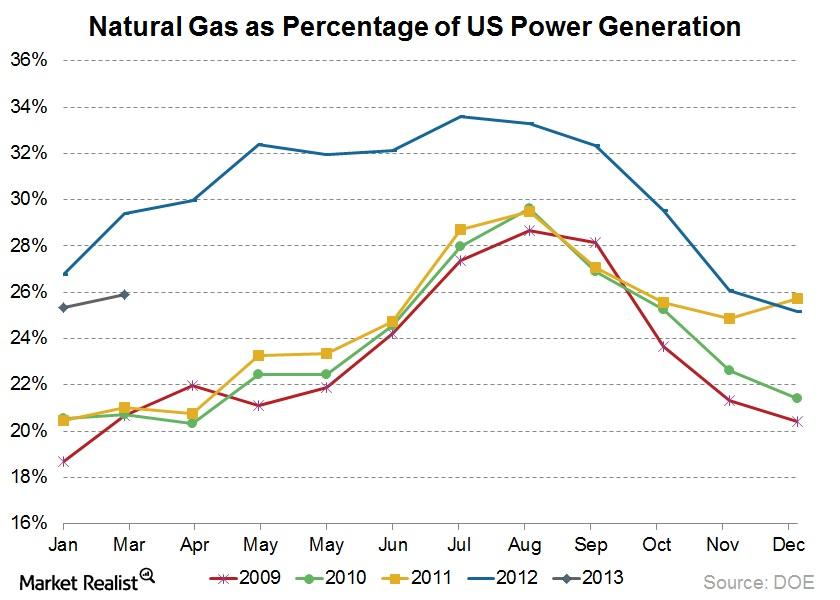

Why has natural gas gained popularity among power generators?

Natural gas has gained market share for use in power generation. Learn about the drivers of this trend and the consequences of increased natural gas use.

Why the spread between WTI and Brent oil drifted wider

The spread between WTI and Brent closed through most of 2013, but it has experienced some volatility in recent months, given events in Libya and Syria.