What Could Drive US Crude Oil Futures This Week?

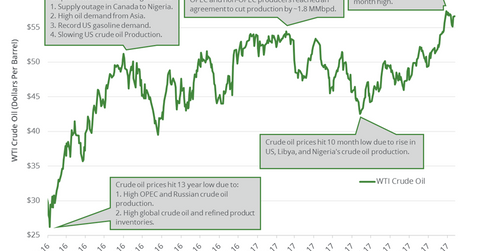

WTI (West Texas Intermediate) crude oil (UWT) (USL) active futures tested $57.35 per barrel on November 6, 2017—the highest level in almost three years.

Nov. 20 2020, Updated 3:19 p.m. ET

Energy calendar

On November 21, 2017, the American Petroleum Institute will release its weekly crude oil inventory report. The U.S. Energy Information Administration will publish its “Weekly Petroleum Status Report” on November 22, 2017. Baker Hughes will release its US oil rig count report on November 24, 2017. All of these events could influence oil (DWT) (DBO) prices this week. Brent (BNO) and US crude oil (DTO) (OIL) are near a multiyear high. Higher oil prices benefit oil producers (PXI) (IEZ) like Noble Energy (NBL), Stone Energy (SGY), Marathon Oil (MRO), and Denbury Resources (DNR).

Bullish crude oil price drivers

WTI (West Texas Intermediate) crude oil (UWT) (USL) active futures tested $57.35 per barrel on November 6, 2017—the highest level in almost three years. The prices rose due to ongoing production cuts, tension in the Middle East, and supply disruptions in Libya, Iraq, Nigeria, and Venezuela.

Any fall in US crude oil inventories could support crude oil (DWT) (USO) prices this week. Any positive announcements related to ongoing productions cuts could also support oil prices.

Bearish crude oil price drivers

WTI crude oil prices tested $26.21 per barrel on February 11, 2017—the lowest level in 13 years. Any increase in US crude oil production could weigh on crude oil (SCO) (UCO) prices this week. Any forecast of slowing crude oil demand in 2017 and 2018 could also impact crude oil prices.

Moving averages

January WTI crude oil futures are above their 20-day, 50-day, and 100-day moving averages on November 17, 2017. It suggests that crude oil prices could trade higher.

Read Crude Oil: Will the Bears Overshadow the Bulls? and Will US natural gas futures continue its downward momentum next week? for the latest updates on crude oil and natural gas.