Top Energy Losses Last Week

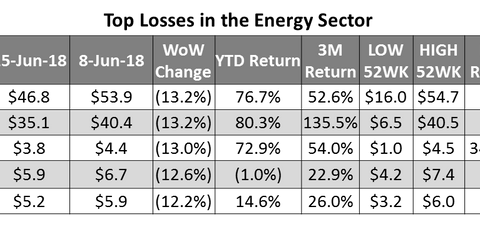

On June 8–15, Whiting Petroleum (WLL) and California Resources (CRC) fell the most on our list of energy stocks.

Dec. 4 2020, Updated 10:53 a.m. ET

Energy stocks

On June 8–15, Whiting Petroleum (WLL) and California Resources (CRC) fell the most on our list of energy stocks. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) fell 3.9% last week—the second-highest decline among the major energy subsector ETFs that we looked at in Part 2 of this series.

We created our list of energy stocks from the following energy subsector ETFs and a few integrated energy stocks:

Other large losses

Denbury Resources (DNR), was third on our list in terms of the largest losses last week.

On June 8–15, oilfield services stocks Ensco (ESV) and Noble (NE) were fourth and fifth on our list, respectively, in terms of the largest losses. Last week, the VanEck Vectors Oil Services ETF (OIH) fell 4.7%—the largest decline among the major energy subsector ETFs.

Energy commodities and the broader market

Last week, US crude oil July futures fell 1%, while natural gas July futures rose 4.6%. The S&P 500 (SPY) didn’t change last week. The top five energy losses underperformed energy commodities and the equity market last week.