Global Crude Oil Supply Outages Are near a 4-Month High

Global crude oil supply outages increased by 208,000 bpd (barrels per day) to 1,738,000 bpd in December 2017—compared to the previous month.

Nov. 20 2020, Updated 1:06 p.m. ET

Global crude oil supply outages

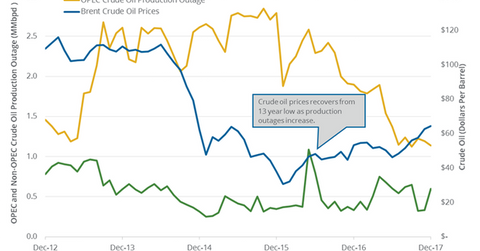

Global crude oil supply outages increased by 208,000 bpd (barrels per day) to 1,738,000 bpd in December 2017—compared to the previous month. Supply outages increased 14% month-over-month but fell by 494,000 bpd or 22% from a year ago. The global crude oil supply outages were near a four-month high.

Any rise in global crude oil supply outages is bullish for oil (BNO) (DBO) prices. Higher oil (USL) prices favor energy producers (FENY) (IYE) like Contango Oil & Gas (MCF), Viper Energy (VNOM), and Ultra Petroleum (UPL).

Highs and lows

Global oil supply outages hit 3.7 MMbpd in May 2016—the highest level since 2011. Brent (BNO) crude oil prices rose 12.4% in May 2016 from April 2016. In contrast, supply outages hit 1.53 MMbpd in November 2017—the lowest level since 2011.

Non-OPEC and OPEC oil supply outages

Non-OPEC oil producers’ supply outages rose by 263,000 bpd to 598,000 bpd in December 2017—compared to the previous month. The United Kingdom had the highest supply outages among non-OPEC producers. Supply outages in the United Kingdom supported crude oil (UCO) (DWT) prices in December 2017.

OPEC producers’ oil supply outages fell by 55,000 bpd to 1,140,000 bpd in December 2017—compared to the previous month. Libya, Saudi Arabia, Kuwait, Iraq, and Nigeria had supply outages among OPEC producers.