Phillips 66’s Strong Performance in 2017

In 2017, Phillips 66 (PSX) was the fifth-best-performing energy stock of the Energy Select Sector SPDR ETF (XLE).

Jan. 26 2018, Updated 10:32 a.m. ET

Phillips 66: The 5th-best performer of 2017

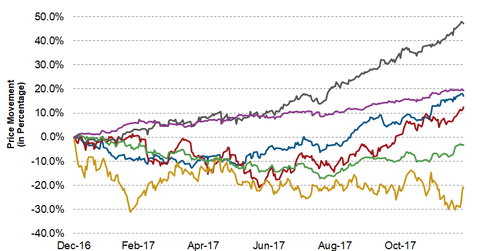

In 2017, Phillips 66 (PSX) was the fifth-best-performing energy stock of the Energy Select Sector SPDR ETF (XLE). Phillips 66 is a refiner with operations in the United States and Europe. In 2017, it rose ~17%, beating the Energy Select Sector SPDR ETF (XLE) by the wide margin. XLE fell ~3% in 2017.

In 2017, Phillips 66 also outperformed unleaded gasoline (UGA) and heating oil (UHN) prices. Gasoline prices rose ~8%, and heating oil prices rose ~22% in 2017. However, Phillips 66 has underperformed the VanEck Vectors Oil Refiners ETF (CRAK), which rose ~47% in 2017.

In comparison, crude oil rose ~12% in 2017, and natural gas fell ~21%. The SPDR S&P 500 ETF (SPY) rose ~19%, and the SPDR Dow Jones Industrial Average ETF (DIA) rose ~25% in 2017.

Phillips 66’s revenues and earnings

In the first nine months of 2017, Phillips 66 reported revenues of ~$73 billion, which was ~20% higher than ~$61 billion in the same period of 2016. It reported a considerable rise of ~36% in its net profit to ~$1.9 billion in the first nine months of 2017, from ~$1.4 billion in the first nine months of 2016.

Phillips 66 will announce its 4Q17 and 2017 earnings on February 2, 2018, before the market opens.

Next, let’s look at the 2017 returns for Range Resources (RRC) and compare them to the broader market and energy commodities. We’ll also analyze its fundamental metrics.