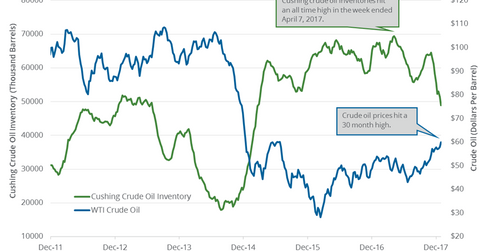

Cushing Inventories Hit February 2015 Low

A Bloomberg survey estimated that the crude oil inventories at Cushing could have fallen by 1.5 MMbbls between December 29, 2017, and January 5, 2018.

Nov. 20 2020, Updated 11:14 a.m. ET

Cushing inventories

Cushing, Oklahoma, is the biggest crude oil storage facility in the US. A Bloomberg survey estimated that the crude oil inventories at Cushing could have fallen by 1.5 MMbbls (million barrels) between December 29, 2017, and January 5, 2018. The EIA will release the crude oil inventory report on January 10, 2018, for the week ending January 5, 2018. Analysts expect that US crude oil inventories would fall by 4.1 MMbbls between December 29, 2017, and January 5, 2018.

Any fall in US and Cushing inventories supports oil (USO) (USL) prices. US crude oil (DBO) prices are near the highest level since December 2014. It also favors funds like the Vanguard Energy ETF (VDE) and the iShares U.S. Energy ETF (IYE). These ETFs have exposure to US oil and gas companies.

EIA’s US and Cushing inventories

Last week, the EIA released its crude oil inventories report on January 4, 2018. It reported that Cushing inventories fell by 2,441,000 barrels or 4.8% to 48.9 MMbbls on December 22–29, 2017. Cushing inventories also fell by 18,536,000 barrels or 27.5% year-over-year.

Any fall in the inventories favors oil (SCO) prices. Higher oil (USL) prices benefit energy producers’ (XOP) (IEZ) earnings like SM Energy (SM), Comstock Resources (CRK), Northern Oil & Gas (NOG), and Whiting Petroleum (WLL).

US crude oil inventories fell by 7.4 MMbbls to 424.4 MMbbls on December 22–29, 2017. The inventories fell by 54.5 MMbbls or 11.4% from a year ago. The inventories also fell ~21% from their peak in March 2017.

Impact

Cushing crude oil inventories were near the lowest level since February 20, 2015. They also fell ~30% from their peak on April 7, 2017. WTI crude oil (DBO) prices have risen ~16% since April 7, 2017. Any fall in US and Cushing inventories supports oil (UWT) prices.

Next, we’ll discuss how US crude oil rigs impact oil prices.