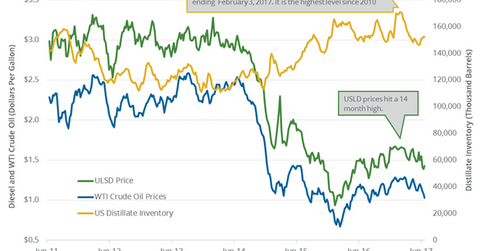

US Distillate Inventories Fell for the First Time in 5 Weeks

The fall in distillate inventories supported diesel and crude oil futures on June 28, 2017. US diesel futures rose 1.4% to $1.43 per gallon on June 28.

Nov. 20 2020, Updated 5:13 p.m. ET

US distillate inventories

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 0.2 MMbbls (million barrels) to 152.3 MMbbls on June 16–23, 2017. Inventories fell for the first time in five weeks. Inventories fell 0.1% week-over-week but rose 1.2% year-over-year.

The fall in distillate inventories supported diesel and crude oil (RYE) (VDE) (XES) futures on June 28, 2017. US diesel futures rose 1.4% to $1.43 per gallon on June 28, 2017. For more on crude oil prices, read Part 1 and Part 2 in this series.

Higher crude oil prices have a positive impact on US crude oil producers’ profitability like Contango Oil & Gas (MCF), Stone Energy (SGY), and W&T Offshore (WTI). Likewise, higher refined products prices have a positive impact on US refiners like Marathon Petroleum (MPC) and Tesoro (TSO).

US distillate production and import

US distillate production rose by 70,000 bpd to 5,244,000 bpd on June 16–23, 2017. Imports rose by 52,000 bpd to 139,000 bpd during the same period. Distillate demand fell by 129,000 bpd to 4,029,000 bpd on June 16–23, 2017.

Distillate exports

According to the EIA, the US exported 1.2 MMbpd (million barrels per day) of distillates in 2016. The US mainly exported distillates to Mexico, Brazil, and the Netherlands in 2016. US distillate exports have been slower in 2017—compared to 2016.

Impact

US distillates inventories are above the five-year range. High distillate inventories would pressure diesel and crude oil futures in 2017.

For more on the crude oil’s price forecast, read Hedge Funds’ Net Long Bullish Positions Hit a 10-Month Low.

Read US and Brent Crude Oil Futures: Will the Recovery Be Short-Lived? and Is It the Beginning of Bottom Fishing for Crude Oil? to learn about crude oil.