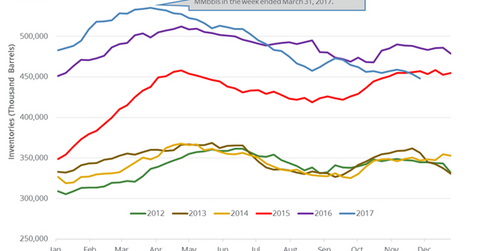

US Crude Oil Inventories Have Fallen 16% from Their Peak

US crude oil inventories fell by 5.6 MMbbls (million barrels) or 1.2% to 448.1 MMbbls on November 24–December 1, 2017, according to the EIA.

Dec. 7 2017, Published 9:39 a.m. ET

US crude oil inventories

The EIA published its weekly crude oil inventory report on December 6, 2017. US crude oil inventories fell by 5.6 MMbbls (million barrels) or 1.2% to 448.1 MMbbls on November 24–December 1, 2017, according to the EIA. Inventories fell by 37 MMbbls or 7.7% from the same period in 2016. Inventories fell for the third consecutive week.

Bloomberg surveys estimated that US crude oil inventories would fall by 2.5 MMbbls on November 24–December 1, 2017. WTI (West Texas Intermediate) oil (USL) (DWT) prices fell on December 6, 2017, despite the massive fall in US oil inventories. We discussed the bearish drivers for oil (USO) (UWT) prices in Part 1 of this series.

WTI oil (UCO) (SCO) prices have fallen ~5% since the highs in November 2017. Any decline in oil prices is bearish for oil and gas producers (IXC) (FENY) like Newfield Exploration (NFX), Laredo Petroleum (LPI), Chesapeake Energy (CHK), and Hess (HES).

US refinery crude oil demand and imports

US refinery crude oil demand rose by 192,000 bpd (barrels per day) or 1.1% to 17,195,000 bpd on November 24–December 1, 2017, according to the EIA. The demand rose by 778,000 bpd or 4.7% YoY (year-over-year).

US crude oil imports fell by 127,000 bpd or 1.7% to 7,202,000 bpd on November 24–December 1, 2017, according to the EIA. They also fell by 1,101,000 bpd or 13.2% YoY.

Impact of US crude oil inventories

Nationwide crude oil inventories rose by ~50 MMbbls or 12.5% above their five-year average for the week ending December 1, 2017. It’s bearish for oil prices. If the difference drops, it’s a bullish sign for oil (DTO) (OIL) prices.

Nationwide crude oil inventories have fallen by ~87.5 MMbbls or 16% from their peak, which is bullish for oil prices.

Next, we’ll analyze whether OPEC is underestimating US crude oil production.