Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

Dec. 4 2017, Published 11:14 a.m. ET

AMZ rose 3.0% last week

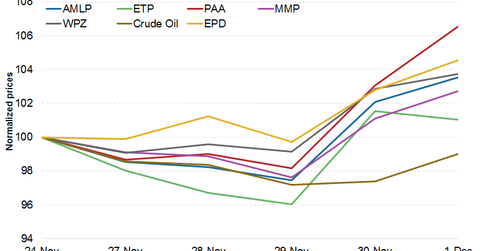

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness. The Alerian MLP Index (AMZ) rose 3.0% during the week and ended at $266.4, despite the slight decline in crude oil prices.

US crude oil fell 1.0% last week, ending at $58.4 per barrel. (For recent update and outlook on crude oil prices, check out the series Battle between Crude Oil Bulls and Bears Is Almost Here.)

Of the 93 MLPs, 60 ended in the green, while 29 ended in red, and the remaining four ended last week flat. Among the top MLPs, Plains All American Pipelines (PAA), Enterprise Products Partners (EPD), Williams Partners (WPZ), and Energy Transfer Partners (ETP) rose 6.6%, 4.5%, 3.7%, and 1.0%, respectively.

The Alerian MLP ETF (AMLP) ended the week 3.5% higher. AMLP outperformed both the Energy Select Sector SPDR Fund (XLE) and the SPDR S&P 500 ETF (SPY) (SPX-INDEX) last week. XLE and SPY rose 2.7% and 1.5%, respectively.

Last week’s gains among MLPs can be mostly attributed to the slight recovery in drilling activity in recent weeks and the recent strong gains in natural gas prices. According to Baker Hughes, the total US rig count has risen to 929 as of December 1, 2017, compared with 898 at the beginning of last month, representing a MoM (month-over-month) increase of 31.

US natural gas rose 8.8% to end at $3.06 per MMBtu (million British thermal units) last week. (For details on top MLPs ranked based on correlation with natural gas, read These MLPs Have the Highest Correlations with Natural Gas.)

Fund flows

The Alerian MLP ETF saw a net outflow of $66.5 million funds last week, despite its strong gains, while the JPM Alerian MLP Index ETN (AMJ) saw a net inflow of $122.8 million funds.