What’s Been Impacting MLP Performances as of December 8?

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

Dec. 12 2017, Updated 7:33 a.m. ET

AMZ fell 1.0% last week

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week. The Alerian MLP Index (AMZ) had a weak start but recovered slightly by December 1, falling 1.0% during the week and ending at 264.4.

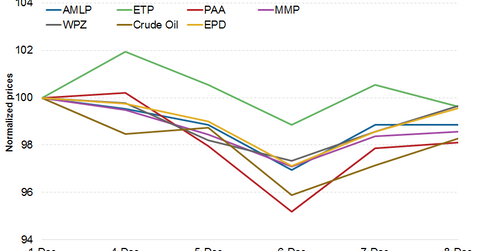

Of the 93 total MLPs, 60 ended in the red, while the remaining 33 ended in the green. Among the top MLPs, Plains All American Pipelines (PAA), Magellan Midstream Partners (MMP), Enterprise Products Partners (EPD), Energy Transfer Partners (ETP), and Williams Partners (WPZ) fell 1.9%, 1.4%, 0.4%, 0.4%, and 0.4%, respectively.

The Alerian MLP ETF (AMLP) ended the week 1.1% lower, outperforming the Energy Select Sector SPDR Fund (XLE) during the week but underperforming the SPDR S&P 500 ETF (SPY) (SPX-INDEX). XLE and SPY fell 1.6% and 0.1%, respectively, that week.

MLPs’ declines that week (ended December 1) can be primarily attributed to general weakness in the US energy sector due to the decline in natural gas and crude oil prices. US crude oil fell 1.7% that week and ended at $57.4 per barrel. Natural gas lost 9.4% to end at $2.8 per MMBtu (million British thermal units). For a recent update and outlook on natural gas, check out US Natural Gas Futures Could Maintain Bearish Momentum.

Fund flows

The Alerian MLP ETF saw a net inflow of $79.1 million funds in the week ended December 1, despite its slight weakness, while the JP Morgan Alerian MLP Index ETN (AMJ) saw a net inflow of $36.2 million funds.