Magellan Midstream Partners, L.P.

Latest Magellan Midstream Partners, L.P. News and Updates

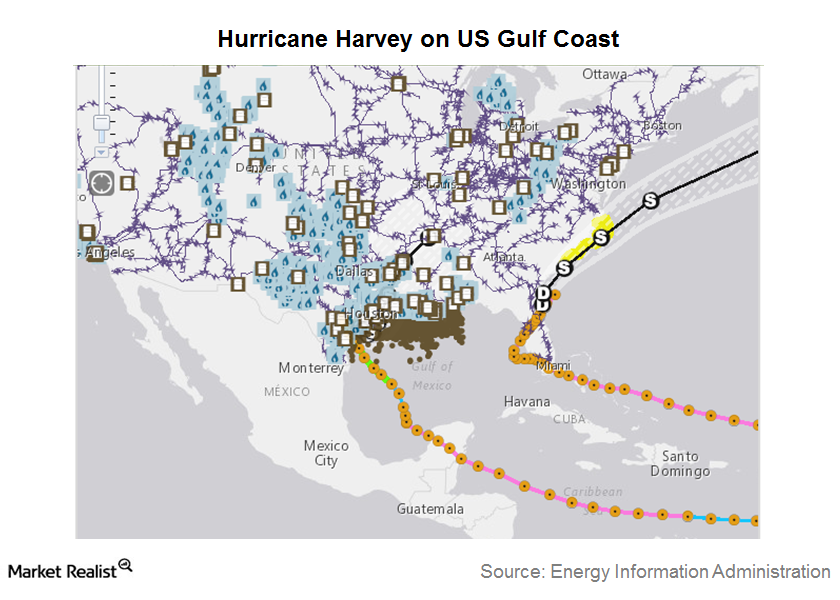

Hurricane Harvey Impacted Energy MLPs

Hurricane Harvey hit the US Gulf Coast last week. The US Gulf Coast is a major destination for US refineries and energy infrastructure.

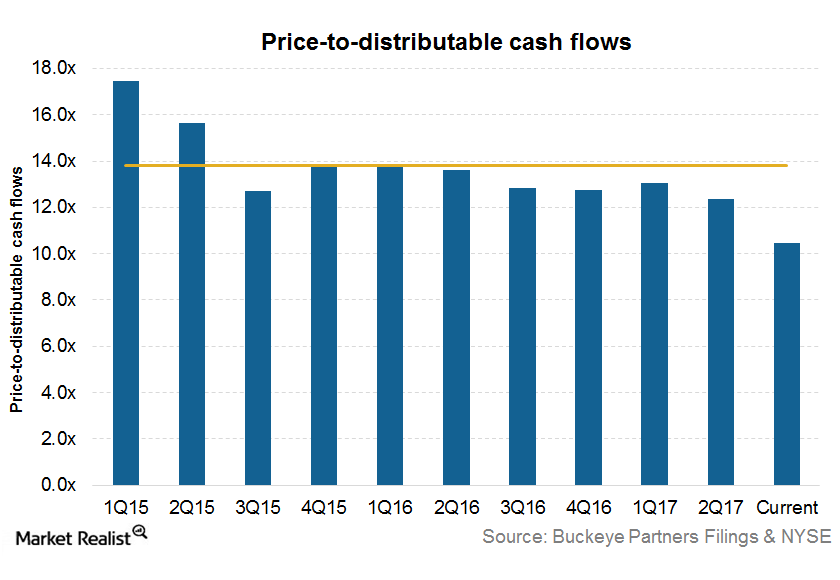

What Buckeye Partners’ Current Valuation Indicates

On October 31, 2017, Buckeye Partners (BPL) was trading at a price-to-distributable-cash-flow multiple of 10.4x, which is significantly below the historical ten-quarter average of 13.8x.

Introducing the UBS ETRACS Alerian MLP Infrastructure ETN AMZIX

The UBS ETRACS 1x Monthly Short Alerian MLP Infrastructure Total Return Index ETN (MLPS) tracks the Alerian MLP Infrastructure Total Return Index (AMZIX).

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

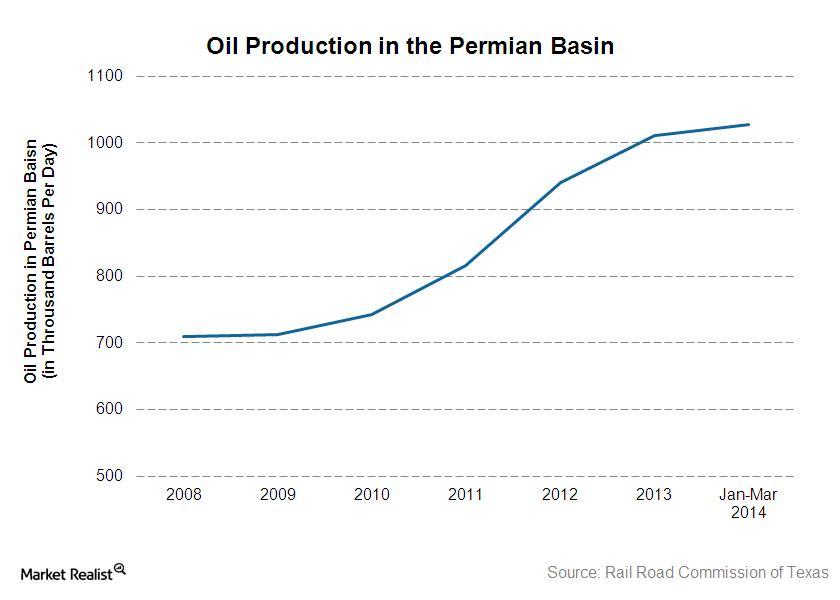

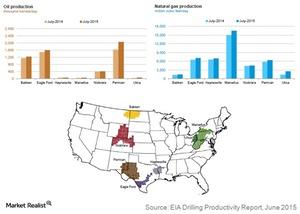

Why oil and natural gas production in the Permian should increase

According to the Energy Information Administration’s short-term energy outlook published in June 2014, crude oil production will average 8.4 million barrels per day in 2014.

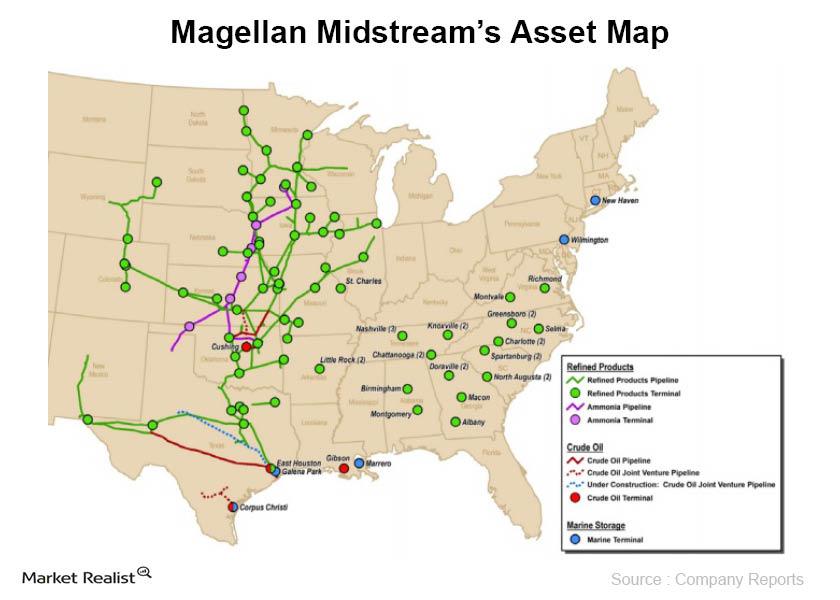

Overview: Magellan Midstream Partners L.P.

Magellan Midstream Partners L.P. (MMP), is a master limited partnership (or MLP) that owns and operates a diversified portfolio of energy infrastructure assets.

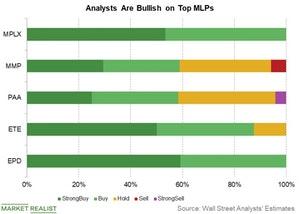

EPD, ETE, PAA, and MMP: What Do Analysts Recommend?

All of the analysts surveyed by Reuters covering Enterprise Products Partners (EPD) and MPLX (MPLX) rated the stocks as “buy.”

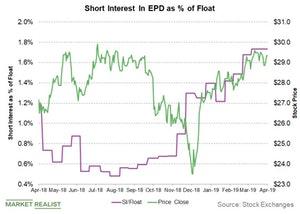

Recent Changes in Enterprise Products Partners’ Short Interest

The short interest in Enterprise Products Partners (EPD) stock rose from 24.9 million shares on March 15 to 25.7 million shares on March 29.

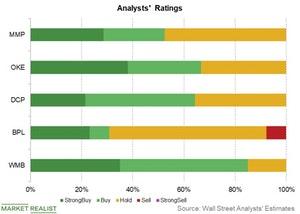

Key MLP and Midstream Rating Updates Last Week

On January 16, Barclays raised its rating for Williams Companies (WMB) from “equal weight” to “overweight.”

Richard Kinder: From Enron to Kinder Morgan

Currently, Richard Kinder owns nearly 11% of Kinder Morgan’s outstanding shares. The stock has underperformed the midstream sector.

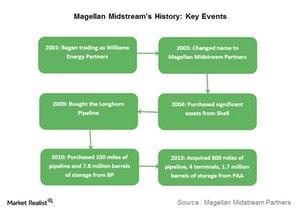

Magellan Midstream Partners: A Brief History

Magellan’s history Magellan Midstream Partners (MMP), which began trading in 2001, has grown through various asset acquisitions and expansion projects over the years. Magellan was formerly a part of Williams Companies (WMB). The company started trading as Williams Energy Partners in 2001, and changed its name to Magellan Midstream Partners in 2003. In 2004, the […]

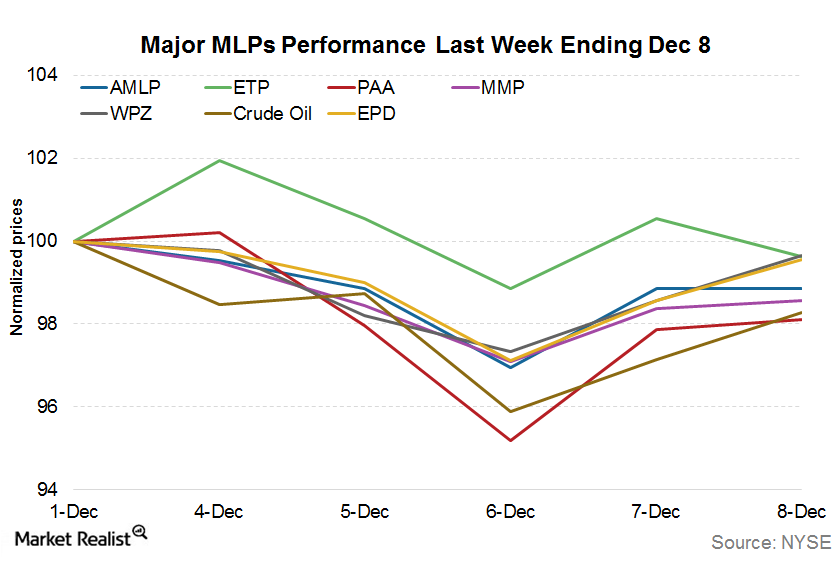

What’s Been Impacting MLP Performances as of December 8?

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

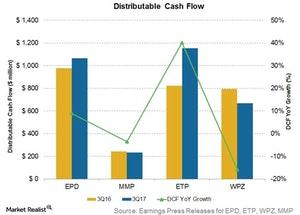

What’s behind ETP’s Strong Distributable Cash Flow Growth?

Energy Transfer Partners’ DCF rose 27.5% YoY to $1,049 million in 3Q17 compared to $823 million in 3Q16.

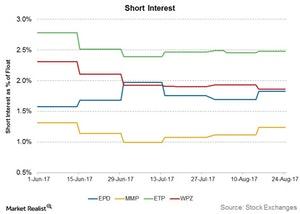

Short Interest in Enterprise Products and Magellan Rose Recently

The short interest as a percentage of float in Enterprise Products Partners’ (EPD) stock is 1.8%—higher than the 1.7% in mid-August.

Must-Know: The 7 Regions for Oil and Gas Production in the US

The EIA (Energy Information Administration) monitors seven key tight oil and gas regions in the US.

The Advantages and Disadvantages of Investing in MLPs

MLPs clearly stand out when compared to other asset classes because of their structure, yields as compared to other asset classes, and stability of cash distribution.

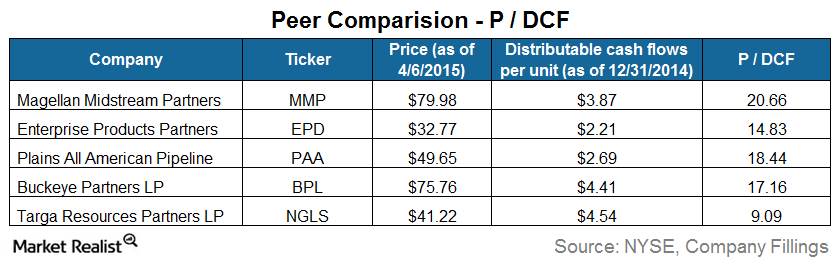

Valuing MLPs: Price-to-Distributable Cash Flow Ratio

MLPs’ valuations are different from other stocks. To value MLPs, the widely used PE ratio isn’t as useful as the PDCF ratio.