Will US Gasoline Demand Help Crude Oil Prices This Week?

According to the EIA, US gasoline demand rose by 423,000 bpd (barrels per day) or 4.6% to 9,595,000 bpd on November 10–17, 2017.

Nov. 29 2017, Published 9:30 a.m. ET

US gasoline demand

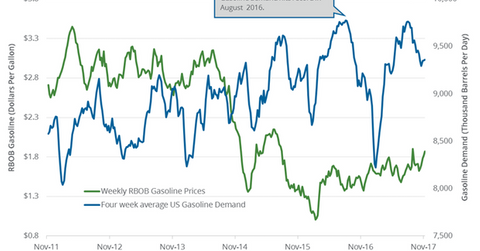

According to the EIA, US gasoline demand rose by 423,000 bpd (barrels per day) or 4.6% to 9,595,000 bpd on November 10–17, 2017. The demand rose by 571,000 bpd or 6.3% from the same period in 2016. A rise in gasoline demand benefits gasoline (UGA) and oil (UCO) (USO) prices.

Higher oil prices benefit oil producers (RYE) (IEZ) like QEP Resources (QEP), Devon Energy (DVN), Occidental Petroleum (OXY), and Bill Barrett (BBG).

Peak and low

US gasoline demand hit a peak of 9,800,000 bpd in July 2017. The strong summer driving period boosted demand. In contrast, gasoline demand tested 8,000,000 bpd in January 2017—the lowest level since February 2014.

So far, US gasoline and crude oil (USL) (UWT) futures have risen 9% and 1.2% in 2017. Oil prices’ gains were limited due to several bearish drivers. However, they’re near a 30-month high on November 28, 2017.

EIA’s US gasoline consumption estimates

US gasoline consumption will average 9,330,000 bpd and 9,350,000 bpd in 2017 and 2018, respectively, according to the EIA. It averaged an annual record of 9,320,000 bpd in 2016. High gasoline demand benefits gasoline prices and US refiners (CRAK) like CVR Energy (CVI) and Marathon Petroleum (MPC).

Impact

The EIA will release its “This Week in Petroleum” report on November 29, 2017. If the EIA reports a rise in US gasoline demand, it could benefit gasoline and oil (UWT) (DWT) prices.

Next, we’ll discuss how improving US crude oil drilling costs and oil exports impact oil prices.