Russia’s Crude Oil Exports Could Pressure Oil Futures

Russia’s energy ministry estimates that the country’s crude oil exports rose 2% or by 160,000 bpd (barrel per day) in the first nine months of 2017.

Nov. 8 2017, Published 9:34 a.m. ET

Russia’s crude oil exports

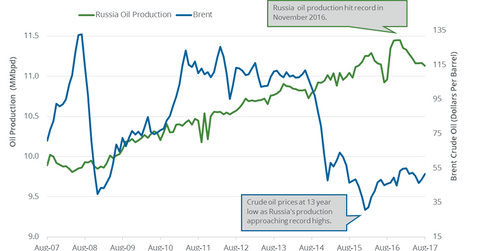

Russia is the largest crude oil producer in the world. Russia’s energy ministry estimates that the country’s crude oil exports rose 2% or by 160,000 bpd (barrel per day) in the first nine months of 2017—compared to the same period in 2016. An increase in Russia’s crude oil exports could add to global supplies and pressure oil prices (BNO) (DWT). Lower oil prices have a negative impact on energy producers (XOP) (FXN) like Shell (RDS.A), BP (BP), Rosneft, Lukoil, Total SA (TOT), Saudi Aramco, and Petro China (PTR).

Russia’s crude oil exports through pipelines

Russia’s crude oil exports through pipelines rose by 325,000 bpd or 7.5% to 4,627,000 bpd in October 2017—compared to September 2017. The rise in exports adds to global supplies and weighs on oil (UCO) (SCO) prices.

Russia crude oil production and ongoing production cuts

Russia’s crude oil production was at 10,930,000 bpd in October 2017—compared to September 2017. OPEC and Russia agreed to cut the crude oil production by 1,800,000 bpd or 2% from January 2017 to March 2018. Russia agreed to curb the production by 300,000 bpd as part of the ongoing production cuts. Russia’s crude oil production has fallen by 317,000 bpd or 2.8% as of October 2017 from 11,247,000 bpd in October 2016.

Impact

Crude oil (USL) (UWT) (UCO) prices are near a 30-month high partially due to the ongoing production cuts. Optimism due to hopes of extending the cuts for nine more months is also driving oil prices. However, higher exports from Russia and the US could offset some of the benefits from the production cuts and pressure oil prices.

In the next part, we’ll discuss how US crude oil production and exports impact oil prices.