Which Natural Gas–Weighted Stocks Could Take Cues from Oil?

Antero Resources (AR) and Gulfport Energy (GPOR) are among the natural gas–weighted stocks that had the highest correlations with natural gas prices in the trailing week.

Nov. 28 2017, Updated 1:22 p.m. ET

Natural gas–weighted stocks

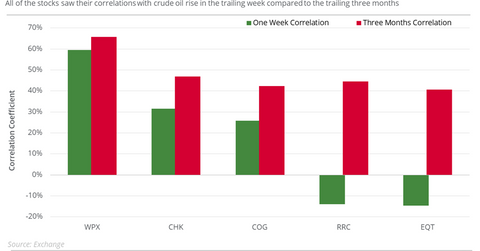

Natural gas–weighted stocks that could follow oil’s moves based on their correlations with oil (USO) (USL) prices between November 20 and November 27, 2017, include:

CHK and WPX had negative correlations with natural gas prices over this period, as we discussed in the previous article. In the past five trading sessions, natural gas had a negative correlation of 88.5% with WTI crude oil prices.

On the other side of this relationship, natural gas–weighted stocks that could avoid signals from oil prices based on their trailing week correlations with US crude oil futures include:

These two stocks were among the natural gas–weighted stocks that had the highest correlations with natural gas prices in the trailing week.

Our list of natural gas–weighted stocks is from the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), and they have at least 60.0% production mixes in natural gas.

How oil could influence natural gas–weighted stocks

Oil prices could be a key fundamental factor for natural gas supplies. Moreover, oil’s sentiment could impact the entire energy sector. As a result, oil frequently influences some natural gas-weighted stocks directly.