Hedge Funds: Bullish or Bearish on Natural Gas?

Aegent Energy Advisors predicts that US natural gas prices might not exceed $3.18 per MMBtu by December 2017.

Nov. 20 2020, Updated 11:29 a.m. ET

Hedge funds

On November 3, 2017, the CFTC (U.S. Commodity Futures Trading Commission) will release its weekly “Commitment of Traders” report. In the previous report, the CFTC reported that hedge funds’ net long positions in US natural gas futures and options contracts fell by 12,278 contracts to 52,414 on October 17–24, 2017. Net long positions fell 19% week-over-week and by 84,617 contracts or 62% from the same period in 2016.

Hedge funds’ net long positions in US natural gas futures and options fell for the fourth time in five weeks. It suggests that hedge funds are bearish or less bullish on US natural gas (UGAZ) (DGAZ) (GASL) prices.

EIA’s US natural gas price forecasts

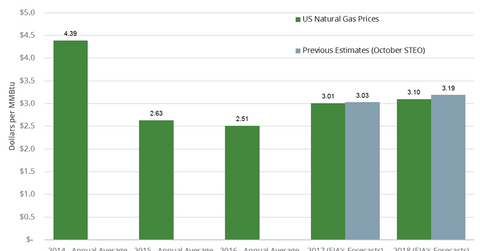

US natural gas (UNG) (BOIL) prices averaged $2.63 per MMBtu (million British thermal units) and $2.51 per MMBtu in 2015 and 2016, respectively. The EIA (U.S. Energy Information Administration) forecast that US natural gas prices could average $3.01 per MMBtu in 2017 and $3.10 per MMBtu in 2018. High prices would be driven by rising exports, strong domestic consumption, and a modest rise in natural gas production. Higher gas prices are bullish for gas producers (USL) (PXI) like Newfield Exploration (NFX), Chevron (CVX), and Gulfport Energy (GPOR).

Aegent Energy Advisors predicts that US natural gas prices might not exceed $3.18 per MMBtu by December 2017. The prices might not exceed $3.29 per MMBtu by March 2018. The World Bank predicts that US natural gas prices could average $3.1 per MMBtu in 2018.

Read Are Russia and the US New Problems for the Crude Oil Market? for the latest updates on crude oil.