Why Cushing Crude Inventories Rose for the 4th Time in 5 Weeks

A market survey estimates that Cushing crude oil inventories fell from September 1 to 8, 2017. Cushing crude oil inventories rose for the fourth time in the last five weeks.

Sept. 11 2017, Updated 5:36 p.m. ET

Cushing crude oil inventories

A market survey estimates that Cushing crude oil inventories fell from September 1 to 8, 2017. Cushing crude oil inventories rose for the fourth time in the last five weeks. A rise in Cushing crude oil inventories is bearish for crude oil (XES)(IEZ) prices.

Lower crude oil (RYE)(IXC) prices have a negative impact on oil and gas producers like the W&T Offshore (WTI), Denbury Resources (DNR), and Cobalt International Energy (CIE).

EIA’s Cushing crude oil inventories

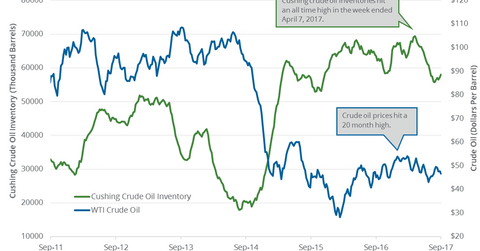

The US Energy Information Administration released its crude oil and gasoline report on Friday, September 8. It reported that Cushing crude oil inventories rose by 797,000 barrels to 58 MMbbls (million barrels) between August 25 and September 1. Inventories rose 1.3% week-over-week but fell 5.4 MMbbls or 8.5% year-over-year.

EIA’s US crude oil inventories

US crude oil inventories rose by 4.5 MMbbls (million barrels) or 1% to 462.3 MMbbls between August 25 and September 1. However, inventories fell 18.3 MMbbls or 3.8% from the same period in 2016. US crude oil inventories rose for the first time in ten weeks.

Impact

Cushing inventories have risen by 2.2 MMbbls or 4% in the last six weeks. But Cushing inventories are down ~15% from its peak. US crude oil inventories are down ~13% from its peak. A fall in US and Cushing crude oil inventories could support crude oil (IXC)(IYE) prices.

Next, we’ll analyze how the US crude oil rig count drives crude oil prices.