US Distillate Inventories Rise for a Third Week

US distillate inventories On August 30, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. The EIA estimates that US distillate inventories rose by 0.5% to 149.1 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell by 5.6 MMbbls, or 3.6%, from the same period in 2016. Inventories […]

Sept. 10 2017, Updated 1:20 p.m. ET

US distillate inventories

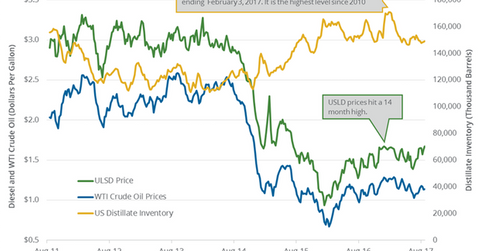

On August 30, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. The EIA estimates that US distillate inventories rose by 0.5% to 149.1 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell by 5.6 MMbbls, or 3.6%, from the same period in 2016. Inventories rose for the third straight week.

A market survey estimated that US distillate inventories could fall 846,000 barrels during that period. US diesel futures contracts for September delivery rose 0.5% to $1.67 per gallon on August 30, 2017. Prices rose despite the surprise rise in distillate inventories.

Diesel and US crude oil (DIG) (DBO) (BNO) futures diverged on August 30, 2017. Moves in diesel and crude oil prices impact earnings of refiners and producers such as Phillips 66 (PSX), Tesoro (TSO), W&T Offshore (WTI), Contango Oil & Gas (MCF), and Denbury Resources (DNR).

US distillate production, imports, and demand

The EIA estimates that US distillate production fell 36,000 bpd (barrels per day) to 5.1 MMbpd (million barrels per day) between August 18 and 25, 2017. However, production rose 82,000 bpd, or 1.6%, from the same period in 2016.

US distillate imports fell by 48,000 bpd to 84,000 bpd between August 18 and 25, 2017. Imports fell 44,000 bpd, or 34%, from the same period in 2016.

US distillate demand fell by 167,000 bpd, or 4.1%, to 3.9 MMbpd between August 18 and 25, 2017. Demand rose 72,000 bpd, or 1.8%, from the same period in 2016.

Impact

US distillate inventories are within their five-year range. A fall in distillate inventories could support diesel prices. Higher diesel prices support crude oil (RYE) (USO) prices.

Read Why Hedge Funds May Be Turning Bearish on US Crude for more on crude oil price forecasts. You could also check out Market Realist’s How India’s Crude Oil Imports, Production, and Demand Impact Prices and How Harvey, OPEC, and US Rigs Are Driving Crude Oil Futures.