Hedge Funds Are Turning Bearish on US Crude Oil

Hedge funds reduced their net long positions in US crude oil futures and options by 12,094 contracts to 157,891 contracts on September 5–12, 2017.

Sept. 19 2017, Updated 12:06 p.m. ET

Hedge funds

The U.S. Commodity Futures Trading Commission released its weekly “Commitment of Traders” report on September 15, 2017. Hedge funds reduced their net long positions in US crude oil futures and options by 12,094 contracts to 157,891 contracts on September 5–12, 2017. These positions fell 7.1% week-over-week and 22.5%, or by 46,053 contracts, year-over-year.

Hedge funds have reduced their net long positions in US crude oil (XLE) (XOP) futures and options for the fourth time in five weeks. It suggests that hedge funds are turning bearish or less bullish on crude oil (IXC) (DIG) (OIH) prices.

Crude oil price forecasts

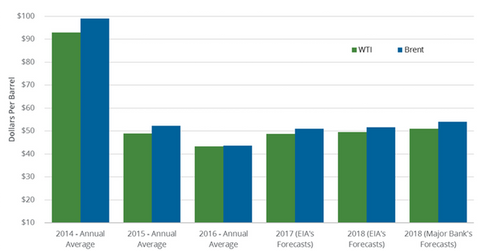

A Wall Street Journal survey estimates that Brent and US crude oil (RYE) (BNO) prices could average $54 per barrel and $51 per barrel in 2018.

The EIA (U.S. Energy Information Administration) released its STEO (Short-Term Energy Outlook) report on September 12, 2017. It estimates that US crude oil prices will average $48.83 per barrel in 2017—0.1% lower than previous estimates from the STEO report in August. US crude oil prices could average $49.58 per barrel in 2018—the same as the previous estimate.

The EIA also estimates that Brent crude oil prices will average $51.07 per barrel in 2017—0.7% higher than previous estimates. Brent crude oil prices could average $51.58 per barrel in 2018—the same as the previous estimate.

US and Brent crude oil prices averaged $43.3 per barrel and $43.7 per barrel, respectively, in 2016.

Read Are US Crude Oil Supply and Demand Tightening? and How Major Oil Producers and the Dollar Are Driving Crude Prices for more on crude oil.

Read Are US Natural Gas Supply and Demand Rebalancing? for updates on natural gas.