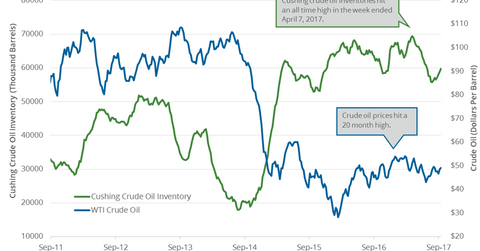

Cushing Crude Oil Inventories Rose for the Fourth Week

Cushing crude oil inventories rose on September 15–22, 2017. A rise in Cushing crude oil inventories is bearish for crude oil (UWT) (DWT) (USO) prices.

Sept. 25 2017, Updated 12:06 p.m. ET

Cushing crude oil inventories

A market survey estimates that Cushing crude oil inventories rose on September 15–22, 2017. A rise in Cushing crude oil inventories is bearish for crude oil (UWT) (DWT) (USO) prices.

Lower crude oil prices have a negative impact on oil and gas producers (XES) (XLE) (IEZ) like ConocoPhillips (COP), Bill Barrett (BBG), Cobalt International Energy (CIE), and Denbury Resources (DNR).

EIA’s Cushing crude oil inventories

Cushing is the largest storage hub in the US. It’s the delivery point for the WTI (West Texas Intermediate) crude oil futures trading in NYMEX.

The EIA (U.S. Energy Information Administration) estimates that Cushing crude oil inventories rose by 703,000 barrels to 59.7 MMbbls (million barrels) on September 8–15, 2017. However, Cushing crude oil inventories have fallen by 2.9 MMbbls or 4.7% year-over-year.

US crude oil inventories

US crude oil inventories rose by 4.6 MMbbls to 472.8 MMbbls on September 8–15, 2017. However, inventories have fallen by 1.1 MMbbls or 0.2% from the same period in 2016. Inventories rose for the third straight week.

Impact

Cushing crude oil inventories rose for the fourth consecutive week for the week ending September 15, 2017. Cushing inventories have risen by 3.9 MMbbls or 7.1% in the last eight weeks. US crude oil inventories are near a seven-week high.

Any rise in US and Cushing crude oil inventories could pressure crude oil (SCO) (DBO) prices.

Next, we’ll analyze how the US crude oil rig count impacts crude oil prices.