Why Were Crude Oil Price Forecasts Downgraded Again?

A Wall Street Journal survey estimates that US crude oil prices could average $51 per barrel in 2018—$2 per barrel lower than previous estimates.

Sept. 12 2017, Published 10:05 a.m. ET

October US crude oil futures

October US crude oil futures are trading below their 20-day, 50-day, 100-day, and 200-day moving averages of $47.66, $47.66, $47.88, and $51 per barrel as of September 11, 2017.

Moving averages suggest that crude oil (UCO) (SCO) (USO) prices could trade lower. Lower crude oil prices have a negative impact on oil and gas producers like Stone Energy (SGY), Northern Oil & Gas (NOG), and Triangle Petroleum (TPLM).

Crude oil price forecasts

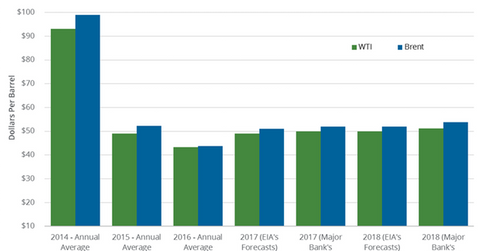

A Wall Street Journal survey estimates that US crude oil (XLE) (XOP) (RYE) (VDE) prices could average $51 per barrel in 2018—$2 per barrel lower than previous estimates.

A Wall Street Journal survey estimates that Brent crude oil prices could average $54 per barrel in 2018—$1 per barrel lower than the previous estimate. Major banks downgraded their oil price forecasts for the fourth consecutive month on August 31 due to the production cut deal expiring by March 2018. Crude oil production from OPEC and Russia would rise after the production cut deal expires.

The EIA (U.S. Energy Information Administration) estimates that the US and Brent crude oil prices will average $49.5 per barrel and $51.6 per barrel in 2018. US and Brent crude oil prices averaged $43.3 per barrel and $43.7 per barrel, respectively, in 2016.

Read How Irma, OPEC, the Dollar, and Rigs Are Driving Crude Oil Futures and Harvey’s Impact on US Supply, Demand, Crude Oil, and Gas to learn more.

For updates on natural gas, read Hurricane Harvey Has Impacted Natural Gas Supplies and Prices.