Will US Crude Oil Inventories Fall Again and Drive Oil Prices?

October WTI crude oil futures contracts rose 0.60% to $47.83 per barrel on August 22, 2017, and Brent crude oil futures contracts rose 0.40% to $51.87 per barrel.

Aug. 23 2017, Published 8:56 a.m. ET

US crude oil futures

October WTI (West Texas Intermediate) crude oil (RYE) (VDE) (XES) futures contracts rose 0.60% to $47.83 per barrel on August 22, 2017. Brent crude oil futures contracts rose 0.40% to $51.87 per barrel that same day.

US crude oil (SCO) (BNO) futures rose due to the following reasons:

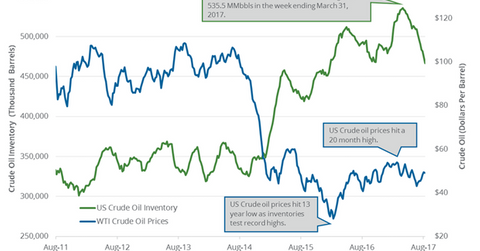

- There was an expectation of a fall in US crude oil inventories of 3.5 MMbbls (million barrels) from August 11–18, 2017, which would be the eighth consecutive week of decline.

- There was an expectation of a potential hurricane in the southwestern Gulf of Mexico on August 23, 2017, or August 24, 2017. There was the possibility of heavy rains, which could flood refineries operating in that region. It supported gasoline futures on August 23, 2017.

- There was an expectation of slowing US crude oil production in the coming months.

However, US crude oil futures have fallen 16.4% YTD (year-to-date) due to bearish drivers. Changes in crude oil prices impact oil ETFs and energy producers. Below are the YTD returns ranked by assets under management for the top five crude oil ETFs:

API’s crude oil inventories

On August 22, 2017, the API (American Petroleum Institute) released its weekly crude oil inventory report. It reported that US crude oil inventories fell 3.5 MMbbls from August 11–18, 2017. The fall in inventories supported US crude oil (XLE) (XOP) prices in post-settlement trade on August 22, 2017.

Market focuses on US crude oil inventories

The EIA (U.S. Energy Information Administration) will release its weekly crude oil and gasoline inventory report on August 23, 2017, at 10:30 AM EST.

Series overview

In this series, we’ll cover US gasoline demand, India’s production and demand, and global crude oil supply outages. Let’s start by looking at the API’s Cushing crude oil and gasoline inventories.