Why Hedge Funds May Be Turning Bearish on US Crude

The US Commodity Futures Trading Commission reported on Friday, August 25, that hedge funds have cut back their bullish positions in US crude futures and options.

Aug. 31 2017, Updated 7:39 a.m. ET

Hedge funds

The US Commodity Futures Trading Commission released its weekly Commitment of Traders Report on Friday, August 25, 2017, reporting that hedge funds have decreased their bullish positions in US crude oil futures and options by 21,467 contracts, or 8.5%, to 274,441 contracts from August 15–22, 2017. These positions rose 12%, or by 30,339 contracts, during the same period in 2016.

Hedge funds have decreased their net bullish positions in US crude oil futures and options for the third-straight week, suggesting that hedge funds are turning bearish or less bullish on crude oil (ERY) (ERX) (SCO) prices.

Notably, lower crude oil prices could have a negative impact on the earnings of oil producers like Hess (HES), Matador Resources (MTDR), and Goodrich Petroleum (GDP).

October US crude oil futures are now trading below their 20-day, 50-day, 100-day, and 200-day moving averages as of August 29. This suggests that prices could trade lower this week.

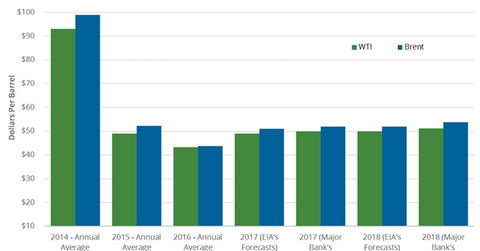

Crude oil price forecasts

The EIA (US Energy Information Administration) estimates that US crude oil (XLE) (XOP) prices could average $48.9 per barrel in 2017, while Brent crude oil prices could average $50.79 per barrel in 2017. WTI (West Texas Intermediate) and Brent crude oil prices averaged $43.3 per barrel and $43.7 per barrel, respectively, in 2016.

For more, check out Market Realist’s “How India’s Crude Oil Imports, Production, and Demand Impact Prices” and our series How Harvey, OPEC, and US Rigs Are Driving Crude Oil Futures.

For more on natural gas, you might be interested in the series Supply and Demand Could Drive Natural Gas Futures in September.