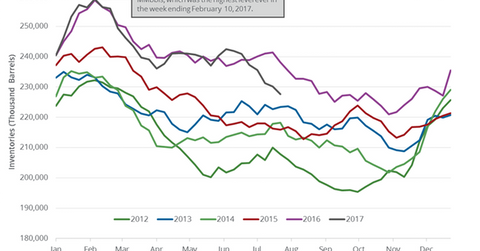

US Gasoline Inventories Fell, Supported Gasoline Oil Prices

The EIA reported that US gasoline inventories fell 1.1% or by 2.5 MMbbls (million barrels) to 227.7 MMbbls on July 21–28, 2017.

Aug. 3 2017, Published 9:48 a.m. ET

US gasoline inventories

The EIA (U.S. Energy Information Administration) released its weekly crude oil and gasoline inventory report on August 2, 2017. It reported that US gasoline inventories fell 1.1% or by 2.5 MMbbls (million barrels) to 227.7 MMbbls on July 21–28, 2017. Inventories fell for the seventh consecutive week. Inventories fell 4.4% from the same period in 2016.

A Bloomberg survey estimated that US gasoline inventories would have fallen by 1 MMbbls on July 21–28, 2017. A larger-than-expected fall in gasoline inventories supported US gasoline and crude oil (FXN) (FENY) (USL) futures. US gasoline futures rose 1% to $1.64 per gallon on August 2, 2017.

Higher crude oil and gasoline prices have a positive impact on refiners and producers’ earnings like Swift Energy (SFY), Phillips 66 (PSX), Valero (VLO), and PDC Energy (PDCE).

US gasoline production, imports, and demand

US gasoline production fell 1% or by 98,000 bpd (barrels per day) to 10.29 MMbpd (million barrels per day) on July 21–28, 2017. Production rose 3% or by 303,000 bpd—compared to the same period in 2016.

US gasoline imports fell 24% or by 174,000 bpd to 549,000 bpd on July 21–28, 2017. Imports fell 13.8% or by 88,000 bpd—compared to the same period in 2016.

US gasoline demand rose 0.2% or by 21,000 bpd to 9.8 MMbpd on July 21–28, 2017—the highest level ever. Demand rose 0.9% or by 90,000 bpd—compared to the same period in 2016.

Impact of gasoline inventories

For the week ending July 28, 2017, US gasoline inventories are below their five-year range. Inventories have fallen ~6% in the last seven consecutive weeks. Inventories are expected to fall due to peak summer demand, which would benefit gasoline and crude oil (ERY) (ERX) prices.

In the next part of this series, we’ll analyze US distillate inventories last week.