US Distillate Inventories Fell for the Fourth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 1.72 MMbbls to 147.7 MMbbls on July 28–August 4, 2017.

Nov. 20 2020, Updated 11:00 a.m. ET

US distillate inventories

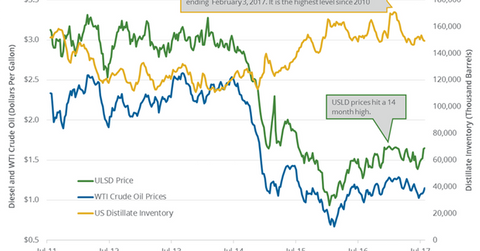

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 1.72 MMbbls (million barrels) to 147.7 MMbbls on July 28–August 4, 2017. Inventories fell 1.1% week-over-week and by 3.5 MMbbls or 2.3% YoY (year-over-year).

A market survey estimated that distillate inventories would have fallen by 0.1 MMbbls on July 28–August 4, 2017. US diesel futures rose on August 9, 2017, due to the larger-than-expected fall in inventories. They rose 1.5% to $1.65 per gallon on August 9, 2017. Likewise, US crude oil (RYE) (USO) (UCO) futures rose on August 9, 2017.

Higher crude oil (IEZ) (XES) (DIG) and diesel prices have a positive impact on oil refiners and producers like Western Refining (WNR), Marathon Petroleum (MPC), Hess (HES), Bill Barrett (BBG), and Swift Energy (SFY).

US distillate production, imports, and demand

US distillate production rose by 73,000 bpd (barrels per day) to 5.3 MMbpd (million barrels per day) on July 28–August 4, 2017. Production rose 1.4% week-over-week and by 566,000 bpd or 11.9% YoY.

US distillate imports fell by 67,000 bpd to 41,000 bpd on July 28–August 4, 2017. Imports fell 62% week-over-week and by 143,000 bpd or 77.7% YoY.

US distillate demand rose by 370,000 bpd to 4.5 MMbpd on July 28–August 4, 2017. Demand rose 8.9% week-over-week and by 573,000 bpd or 14.5% YoY.

Impact

Inventories are below the five-year range. Inventories fell for the fourth straight week. They also fell ~3% in the last eight weeks. An expectation of a fall in distillate inventories would support diesel prices, which would benefit crude oil (XLE) (XOP) futures.

Read Crude Oil: Price Forecasts and Hedge Funds’ Position for more information on crude oil price forecasts.

Read Decoding Global Crude Oil Demand and Supply Drivers and Will the OPEC and Non-OPEC Meeting Drive Crude Oil Futures? for more information.

For more on natural gas, read Supply and Demand Could Drive Natural Gas Prices Higher.