Why Is US Crude Oil Production at a 2-Year High?

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 79,000 bpd or 0.83% to 9,502,000 bpd on August 4–11, 2017.

Nov. 20 2020, Updated 1:57 p.m. ET

US crude oil production

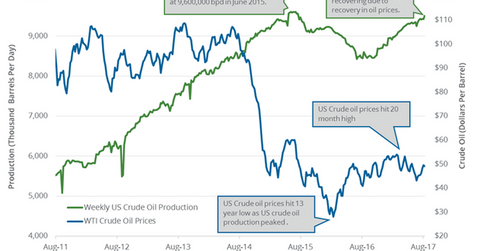

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 79,000 bpd (barrels per day) or 0.83% to 9,502,000 bpd on August 4–11, 2017. Production rose by 905,000 bpd or 10.5% from the same period in 2016.

Production is at the highest level since July 2015. Crude oil (IXC) (IYE) prices fell on August 16, 2017. The EIA’s inventory report showed that US production rose last week.

Energy sectors’ top losers

Lower crude oil (ERY) (ERX) prices have a negative impact on energy producers. The energy sector’s top losers percentage change as of August 16, 2017, are mentioned below.

Why US crude oil production hit a two-year high

US crude oil production hit 8.4 MMbpd (million barrels per day) in July 2016—the lowest level since May 2014. It has risen 13% since the low in May 2014 due to the following:

- There were higher crude oil prices in 2H16 and early 2017.

- US crude oil rigs have risen 94% year-over-year as of August 11, 2017.

- Drilling technology and efficiency improved.

- US shale producers’ breakeven and production costs improved.

US crude oil production estimates

The EIA estimates that US crude oil production could average 9.35 MMbpd in 2017 and 9.91 MMbpd in 2018. Production is expected to hit a record in 2018. US production averaged 8.9 MMbpd in 2016.

Impact

President Trump’s energy plans could increase US crude oil production. Market surveys project that a rise in production from the US, Brazil, Canada, and Libya could offset the production cut deal. It would pressure oil (RYE) (VDE) prices.

In the next part of this series, we’ll look at US gasoline inventories.