Russia’s Crude Oil Production Was Flat Again

The Russian Energy Ministry estimates that Russia’s crude oil production was flat at 10.95 MMbpd in July 2017—compared to the previous month.

Aug. 8 2017, Published 9:11 a.m. ET

Russia’s crude oil production

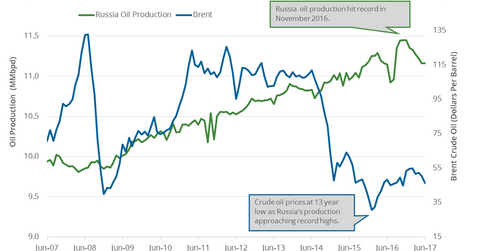

The Russian Energy Ministry estimates that Russia’s crude oil production was flat at 10.95 MMbpd (million barrels per day) in July 2017—compared to the previous month. Production is flat for the third consecutive month.

Russia is the largest crude oil producer in the world. Russia’s crude oil production has fallen since November 2016 due to OPEC’s production cut deal. A fall in Russia’s crude oil production is bullish for crude oil (VDE) (IEZ) (UCO) prices.

Higher crude oil (PXI) (USL) prices have a positive impact on oil producers’ earnings such as Rosneft, Noble Energy (NBL), Bonanza Creek Energy (BCEI), and QEP Resources (QEP).

Russian oil producers

Rosneft is Russia’s largest crude oil producer and exporter. Its crude production rose 11.1% year-over-year in 2Q17. Rosneft’s production rose 0.2% in June 2017. It indicates that production will likely rise in the coming months.

Russia’s crude oil production estimates

Russia’s crude oil production averaged 11.0 MMbpd in 1H17. Its production rose 1.4% year-over-year in 1H17. Market surveys estimate that Russia’s crude oil production could average 11.1 MMbpd in 2017. Russia’s crude oil production averaged ~11.0 MMbpd in 2016—the highest level in the last 30 years.

Production cut deal

OPEC and Russia need to cut their production until March 2018 due to the production cut deal. Russia has pledged to cut its production by 300,000 bpd (barrels per day).

The fall in production could support crude oil (IXC) (IYE) prices in 2017. Douglas Westwood is a market intelligence company. A Douglas Westwood survey suggests that Russia and OPEC’s production could rise after the production cut deal expires. The increase would likely pressure crude oil prices.

Douglas Westwood expects that crude oil oversupply could return in 2018 and persist until 2021.

In the next part, we’ll discuss global crude oil demand and some crude oil price forecasts.