Harvey and API Crude Oil Inventories: The Impact on Crude Futures

US crude oil futures contracts for October delivery fell 0.3% to $46.44 per barrel on August 29, 2017.

Aug. 30 2017, Published 5:24 p.m. ET

US crude oil futures

US crude oil (IEZ) (USO) (UCO) futures contracts for October delivery fell 0.3% to $46.44 per barrel on August 29, 2017. US crude oil futures fell for the second-straight day due to the expectation of weak demand due to Tropical Storm Harvey. A Reuters survey estimates that ~3 MMbpd (million barrels per day) of refinery crude oil demand is offline, making up ~16% of the total US refinery capacity.

Heavy rains are expected until August 30, 2017, and so the restart of refinery and production activity could be delayed. Tropical Storm Harvey has led to massive flooding. Some US refineries and oil production units may take even several weeks to restart.

US crude oil (XLE) (XOP) futures are at a five-week low, having already fallen 18.8% YTD (year-to-date) due to bearish drivers. Lower crude oil prices have had a negative impact on the earnings of oil producers like Chevron (CVX), ExxonMobil (XOM), Warren Resources (WRES), and QEP Resources (QEP).

API’s crude oil inventories

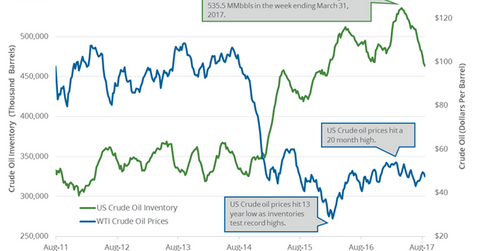

The API (American Petroleum Institute) released its weekly crude oil and gasoline inventory report on August 29, 2017, reporting that US crude oil inventories fell 5.8 MMbbls between August 18, 2017, and August 25, 2017. A market survey estimated that US crude oil inventories would fall 1.8 MMbbls during the same period.

US crude oil (RYE) (VDE) prices fell in post-settlement trade on August 30, 2017, despite the larger-than-expected fall in US crude oil inventories. The API estimates that US crude oil inventories have fallen ~46 MMbbls in the past ten weeks.

EIA’s US crude oil inventories

On August 30, 2017, the EIA (US Energy Information Administration) released its weekly crude oil inventory report at 10:30 AM.

In this series, we’ll cover US gasoline prices, demand, and some crude oil price forecasts. We’ll start by looking at the API’s Cushing crude oil and gasoline inventories.