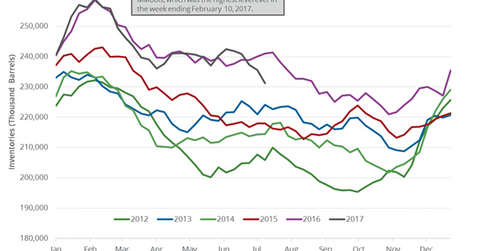

US Gasoline Inventories Drive Gasoline and Crude Oil Prices

The EIA reported that US gasoline inventories fell by 4.4 MMbbls (million barrels) to 231.2 MMbbls on July 7–14, 2017.

July 20 2017, Published 9:53 a.m. ET

US gasoline inventories

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on July 19, 2017. It reported that US gasoline inventories fell by 4.4 MMbbls (million barrels) to 231.2 MMbbls on July 7–14, 2017. Inventories fell 1.8% for the week ending July 14, 2017— compared to the previous week. However, inventories rose 4.1% from the same period in 2016.

A Reuters survey estimates that US gasoline inventories would have fallen by 0.7 MMbbls on July 7–14, 2017. A larger-than-expected fall in gasoline inventories supported gasoline prices. US gasoline futures rose 1.5% to $1.60 per gallon on July 19, 2017. It supported US crude oil (FXN) (SCO) (BNO) prices.

Moves in gasoline and crude oil prices impact oil producers and refiners such as Stone Energy (SGY), Phillips 66 (PSX), Tesoro (TSO), Valero (VLO), and Denbury Resources (DNR).

US gasoline production, imports, and demand

US gasoline production fell by 400,000 bpd (barrels per day), or 3.8%, to 10.1 MMbpd (million barrels per day) on July 7–14, 2017. Production rose 0.2% from the same period in 2016.

The EIA reported that US gasoline imports rose by 63,000 bpd, or 12%, to 591,000 bpd on July 7–14, 2017. Imports fell by 306,000 bpd, or 34%, from the same period in 2016.

Weekly US gasoline demand fell by 194,000 bpd, or 2%, to 9.5 MMbpd on July 7–14, 2017. Demand fell by 193,000 bpd, or 2%, from the same period in 2016.

Impact of gasoline inventories

Inventories fell for the fifth consecutive week. They have fallen by 11.2 MMbbls, or 4.4%, in the last five weeks. Gasoline demand is expected to hit a record this summer, which would support gasoline prices. As a result, it would benefit crude oil (ERY) (ERX) prices.

In the next part of this series, we’ll take a look at US distillate inventories.