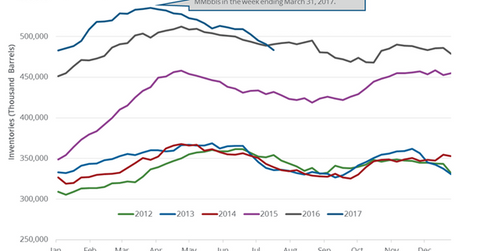

US Crude Oil Inventories Fell below the 5-Year Average

The EIA reported that US crude oil inventories fell by 7.2 MMbbls to 483.4 MMbbls on July 14–21, 2017. Inventories fell below the five-year range.

Nov. 20 2020, Updated 12:47 p.m. ET

Crude oil prices

WTI (West Texas Intermediate) crude oil futures contracts fell 0.3% to $48.6 per barrel in electronic trading at 1:40 AM EST on July 27, 2017. Prices are near a two-month high due to improving crude oil demand and bullish drivers.

Moves in crude oil prices impact funds such as the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), and the Guggenheim S&P 500 Equal Weight Energy ETF (RYE). These ETFs fell 3.4%, 0.15%, and 0.19%, respectively, on July 26, 2017.

Moves in crude oil prices also impact oil producers such as SM Energy (SM), Sanchez Energy (SN), and Goodrich Petroleum (GDP).

EIA’s crude oil inventories

On July 26, 2017, the EIA (U.S. Energy Information Administration) released its Weekly Petroleum Status Report. It reported that US crude oil inventories fell by 7.2 MMbbls (million barrels) to 483.4 MMbbls on July 14–21, 2017. Inventories fell below the five-year range—the lowest level since January 6, 2017. US crude oil inventories fell 1.5% week-over-week and 1.4% YoY (year-over-year).

A Reuters survey estimated that inventories could have fallen by 2.6 MMbbls on July 14–21, 2017. The massive fall in US crude oil inventories supported US crude oil (USO) (IEZ) prices on July 26, 2017.

Refinery demand and imports

US refinery crude oil demand rose by 166,000 bpd (barrels per day) to 17,285,000 bpd on July 14–21, 2017. Refinery demand is at the highest level ever. US refinery crude oil demand rose 1% week-over-week and 4.2% YoY.

US crude oil imports rose by 48,000 bpd to 8,044,000 bpd on July 14–21, 2017. Imports rose 0.6% week-over-week but fell 4.65% YoY.

Why did US crude oil inventories fall?

US crude oil inventories fell below the five-year range due to the following factors:

- record refinery demand

- a YoY fall in US crude oil imports

- a rise in US crude oil exports in 2017

- a fall in US crude oil imports from Saudi Arabia to a seven-year low

Impact of US crude oil inventories

US crude oil inventories have fallen almost 10% from an all-time high. Inventories have fallen for the 14th time in the last 15 weeks. They have fallen by ~50 MMbbls or 10%. The EIA estimates that US crude oil inventories could hit 477 MMbbls by December 2017. The expectation of a fall in US inventories would boost crude oil prices. Higher crude oil prices have a positive impact on oil producers such as Sanchez Energy (SN) and Goodrich Petroleum (GDP).

In the next part, we’ll look at how US crude oil production could impact oil prices.