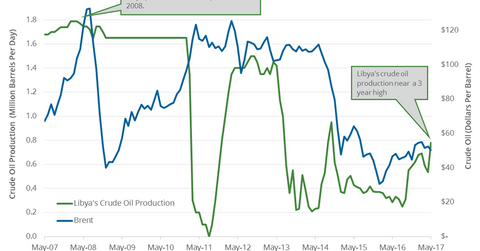

Libya’s Crude Oil Production Is at a 4-Year High

August West Texas Intermediate (or WTI) crude oil futures contracts rose $1.03 per barrel, or 2.2%, and settled at $47.07 per barrel on July 3, 2017.

Nov. 20 2020, Updated 11:01 a.m. ET

Crude oil futures

August West Texas Intermediate (or WTI) crude oil (RYE) (XLE) (USO) futures contracts rose $1.03 per barrel, or 2.2%, and settled at $47.07 per barrel on July 3, 2017. This level was the highest since June 6, 2017. Prices rose for the eighth straight day due to a fall in monthly and weekly US crude oil production.

Higher crude oil prices have a positive impact on oil and gas exploration and production companies. Oil producers such as ExxonMobil (XOM), Chevron (CVX), and Denbury Resources (DNR) have risen 3.3%, 3.1%, and 16.7%, respectively, in the last month.

US crude oil futures have risen more than 10% compared to the ten-month low they hit on June 21, 2017. For details on the bullish drivers of futures prices in this period, read Crude Oil Futures Rose for the Seventh Straight Day. However, prices have since fallen 17.7% due to bearish drivers.

Libya’s crude oil production

Bloomberg surveys estimate that Libya’s crude oil production has risen to 1.1 MMbpd (million barrels per day), its highest level in four years. Market surveys reported production of 1 MMbpd.

Libya’s crude oil production was 690,000 in early January 2017. Its production has risen 64% from its January 2017 levels. Any rise in production in Libya could weigh on crude oil prices.

US crude oil demand

Crude oil futures traders expect the summer driving season to draw down US crude oil inventories. US crude oil exports to Asia could also draw down US crude inventories. This potential fall in inventories could support oil prices.

S&P 500

The S&P 500 Index (SPY) (SPX-INDEX) rose 0.23% to 2,429 on July 3, 2017. The S&P 500 hit 2,453.5 on June 19, 2017, its highest level ever. Bullish momentum in SPY could support energy demand and the energy sector.

In the next article of the series, we’ll look at how the US dollar drives oil prices.