Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

May 19 2017, Updated 9:07 a.m. ET

Exploring valuations

Until now, we’ve evaluated how Marathon Petroleum (MPC) stock has outperformed its peers and the broader market in terms of Trump trade, its moving averages, its dividend yield, and its PEG ratio. Now, let’s look at Marathon Petroleum’s valuation compared to its peers’.

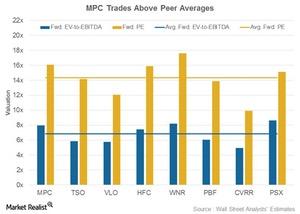

Currently, MPC is trading at a forward PE (price-to-earnings ratio) of 16.1x, above the peer average of 14.3x. MPC’s peers Western Refining (WNR), HollyFrontier (HFC), and Phillips 66 (PSX) are also trading above the peer average.

Marathon Petroleum’s valuation compared to peers

Moving on to EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization), Marathon Petroleum is trading at a forward EV-to-EBITDA of 8x, above the peer average of 6.9x.

Most of MPC’s peers are trading above or around the average forward EV-to-EBITDA. WNR, HFC, and PSX are trading at 8.2x, 7.4x, and 8.6x forward EV-to-EBITDAs, respectively.

Tesoro (TSO), Valero Energy (VLO), and PBF Energy (PBF) are trading below the peer averages in terms of both multiples.

If you’re looking for exposure to mid-cap stocks, you can consider the SPDR S&P MidCap 400 ETF (MDY). The ETF has ~3% exposure to energy sector stocks, including HFC and WNR. If you want exposure to big US companies, you can look at the SPDR S&P 500 ETF (SPY) and the SPDR Dow Jones Industrial Average ETF (DIA). These ETFs have ~6% exposure each to energy sector stocks.

Why does MPC’s valuation command a premium?

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value. The company is focusing on increasing shareholder value by growing its Midstream segment. It also plans to drop down its midstream assets to MPLX LP (MPLX), its MLP.

MPC also intends to separate its Marketing segment, also known as its Speedway segment. Perhaps the markets are assigning higher valuations to MPC due to the potential value they see in its execution of its strategic plan.

In the next article, we’ll look at MPC’s beta position compared to its peers’.