How the Dollar Could Impact Oil’s Recovery

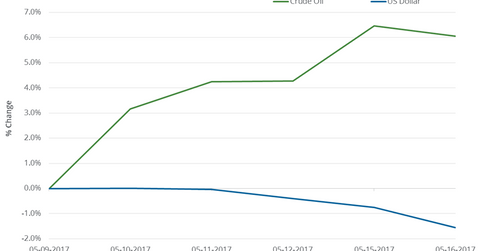

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery rose 3.7% between May 10 and May 17, 2017.

Nov. 20 2020, Updated 2:18 p.m. ET

How the dollar could impact oil’s recovery

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery rose 3.7% between May 10 and May 17, 2017. During the same period, the US Dollar Index (UUP) (USDU) (UDN) fell 1.8%.

In the past five trading sessions, crude oil and the US dollar have moved in opposite directions in three instances. The correlation between crude oil and the US dollar in the past five trading sessions has been 59.8%, which doesn’t show an inverse relationship between the US dollar and oil prices in the short term.

However, when the dollar falls, it makes crude oil cheaper for oil importers. A falling dollar could mean that oil importers would use the opportunity to buy more crude oil, which in turn could support crude oil prices.

The Fed and the US dollar

The Fed’s monetary policy impacts the US dollar. In its last monetary policy review on May 3, 2017, the Fed maintained the status quo. However, the market expects the Fed to hike interest rates twice by the end of 2017. An increase in interest rates could boost the dollar, which could adversely impact oil prices.

The long-term correlation between crude oil and the dollar

Between September 2007 and June 2013, the rolling one-month correlation between crude oil and the US dollar was positive in only a few instances. The correlation was mostly negative during the period.

But, since June 2013, the correlation between crude oil and the US dollar has frequently been positive. The correlation has varied between -64.0% and 43.0% since June 2013.

So, fundamental factors likely dominated price movements. Presently, Trump’s economic, energy, and climate policies along with global oil demand drivers could be key to oil prices.

ETFs and crude oil

ETFs like the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3X ETF (DRIP), the Direxion Daily Energy Bear 3X ETF (ERY), the First Trust Energy AlphaDEX ETF (FXN), the United States Brent Oil ETF (BNO), and the United States Oil ETF (USO) are affected by movements in crude oil. In the next part, we’ll discuss crude oil’s forward curve.