Will US Non-Farm Payrolls Impact Crude Oil Prices?

US (VFINX) (VOO) non-farm payrolls rose by 161,000 in October 2016, according to the U.S. Bureau of Labor Statistics’ report released on November 4, 2016.

Nov. 7 2016, Published 12:12 p.m. ET

US non-farm payrolls

US (VFINX) (VOO) non-farm payrolls rose by 161,000 in October 2016, according to the U.S. Bureau of Labor Statistics’ report released on November 4, 2016. The expectation was for an increase of 175,000. The smaller-than-expected payroll number could impact the timing of the next rate hike. It suggests that the US economic (VFINX) (VOO) recovery is moving at a slower-than-expected pace.

US job data impact crude oil

The US payroll number is one of the most important economic data points that impacts interest rate decisions. The market’s expectation of a delay in the rate hike following the news could lead the fall in US Dollar Index (UUP). It could have a positive impact on crude oil prices. Also, the Fed might delay the rate hike if the market becomes volatile after the election. However, a weak labor market and a weak economy could mean less crude oil demand. It could pressure crude oil prices.

US Dollar Index and crude oil

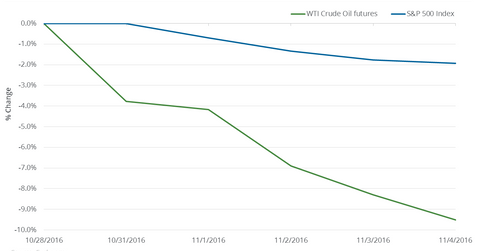

In the past five trading sessions, the correlation between crude oil prices and the US dollar (UUP) was -38.4%. The correlation is negative. It indicates the US dollar’s inverse impact on crude oil prices. A weaker dollar makes crude oil cheaper for oil-importing countries—this boosts prices. The opposite is also true.

So, the evolution of trends in employment data is an important factor. It can directly or indirectly impact crude oil prices in more than one way.

Impact on energy ETFs

Energy ETFs are also impacted by economic data and the correlation between crude oil prices (UWTI) (USO) (OIIL) (USL) (SCO) (DWTI) (UCO) and the US Dollar Index. These ETFs include the Direxion Daily Energy Bear 3X ETF (ERY), the First Trust Energy AlphaDEX ETF (FXN), the United States Brent Oil ETF (BNO), the Energy Select Sector SPDR ETF (XLE), and the United States Oil ETF (USO).

In the next part, we’ll discuss the weather forecast and how it impacts natural gas prices.