What Contango Could Mean for Natural Gas Traders

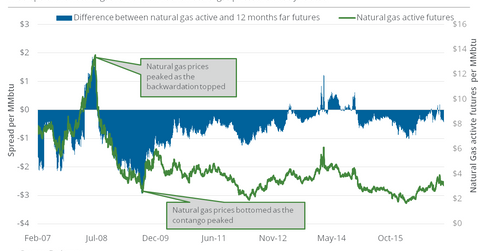

Active natural gas futures are currently trading at a discount of $0.56 to the futures contracts 12 months ahead. The situation is called “contango.”

Feb. 16 2017, Updated 2:35 p.m. ET

Contango and natural gas prices

Active natural gas (UNG) (FCG) (BOIL) (GASL) futures are currently trading at a discount of $0.56 to the futures contracts 12 months ahead. The situation is called “contango” in the natural gas futures market. It represents markets’ sentiment for weaker demand for natural gas and the likelihood of higher demand and higher prices in the future.

Historically, periods of weak natural gas prices coincided with such a structure. Recently, the active futures contract switched to a discount to the contract 12 months ahead on December 12, 2016. Since then, natural gas active futures have fallen ~16.6%.

Backwardation and natural gas prices

On the other hand, when there’s an immediate demand for natural gas, active natural gas futures trade at higher prices than the futures contracts for the months ahead. The situation in the futures market is called “backwardation.”

Historically, periods of strong natural gas prices coincided with the backwardation structure. Natural gas (GASX) (UGAZ) (DGAZ) active futures closed at $13.6 per barrel on July 3, 2008—the highest since January 2007—after almost four months of the active natural gas futures contracts trading at a discount to contracts 12 months ahead.

Active natural gas futures traded at a premium of $1.86 to futures contracts 12 months ahead at the peak on June 6, 2008. As the premium switched to a discount course of the following 13 months—with active futures hitting a discount of $2.94 to futures contracts 12 months ahead—natural gas prices lost 73.2%.

So, the dynamics of futures contracts in the natural gas market can hint at coming changes in natural gas prices.

Impact of the natural gas forward curve

The dynamics of futures contracts in the natural gas market can have implications on natural gas processing and storage MLPs (AMLP). They could impact upstream natural gas producers’ (XOP) hedging decisions.

The fall in the spread could point to tightening in the natural gas demand-supply balance. It could mean that the market sees higher prices coming in the spot natural gas market. It could also mean that upstream producers have been hedging their future production at higher prices.

The dynamics of futures contracts in the natural gas market could also have important implications for the performance of commodity tracking ETFs such as the United States Natural gas (UNG). Due to the contango structure in the natural gas market lately, UNG underperformed natural gas prices. It could change if the natural gas market switched to backwardation.