2016 US Sector Performance: Top Performers in Energy and Financials

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure.

Feb. 7 2017, Published 1:16 p.m. ET

Positive economic data supports the upside

With oil prices down in the first quarter, 2016 began on a rough note for the energy industry. By the end of the year, the US economy (SPY) (QQQ) rebounded with improved economic performance in 4Q16. The improvements included:

- Output exceeded its pre-crisis peak by 10% and is currently is estimated at 3%[1. annualized rate] for 2016.

- Private sector employment growth has sharply reduced unemployment.

- There was regained fiscal sustainability, which increased corporate profits.

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure. The rise in interest rates is also expected to contribute to a more robust and sustainable expansion.

Gold and bonds outperformed stocks in 2016, similar to the 2008 meltdown. According to Morgan Stanley Private Wealth Management’s Andy Chase, the best bets in 2017 include the healthcare and financials sectors due to their attractive valuations.

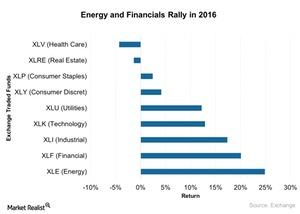

Top performers of 2016

Energy companies saw their returns surge in 2016, mostly due to an improvement in oil prices. Resolute Energy (REN) and Clayton Williams Energy (CWEI) gained about 800% and 300%, respectively. The energy sector (XLE) posted gains of ~25%, as we can see in the chart above.

At the beginning of 2016, the economy saw commodities struggle due to declining prices, but they rebounded after 1Q16. Commodity prices recovered from multiyear lows and boosted their performance in 2016.

The financial sector includes Bank of America (BAC) and Citigroup (C), which performed well with gains of about 30% and 15%, respectively. The sector (XLF) put up gains of about 20% in 2016. The Federal Reserve’s interest rate hike and substantial economic activity helped increase the demands of capital, which benefited this sector.

Worst performers of 2016

The healthcare sector had a rough year in 2016, with uncertainties surrounding the Affordable Care Act, drug pricing, and FDA approvals. The Health Care Select Sector SPDR ETF (XLV) fell about 4% in 2016.

However, the depressed healthcare sector can provide opportunity for investors, as the sector’s valuation appears to be below average. Plus, healthcare demand is increasing with an aging population.

The real estate sector is struggling with solid expectations of rising interest rates. Although the sector rebounded after the 2008 mortgage crisis, the surge in apartment demand offset increased rents, affecting the sector’s profitability.