Resolute Energy Corp

Latest Resolute Energy Corp News and Updates

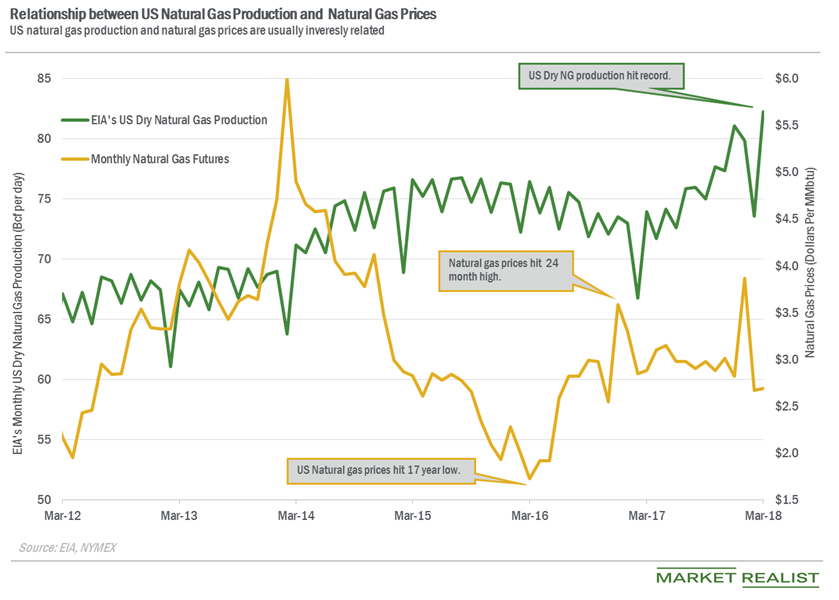

Decoding US Natural Gas Consumption Trends

PointLogic estimates that US natural gas consumption rose ~2.1% to 57.8 Bcf (billion cubic feet) per day from May 31 to June 6.

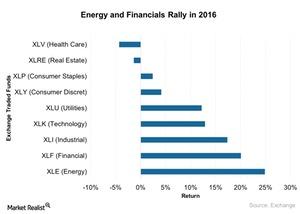

2016 US Sector Performance: Top Performers in Energy and Financials

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure.