Clayton Williams Energy Inc

Latest Clayton Williams Energy Inc News and Updates

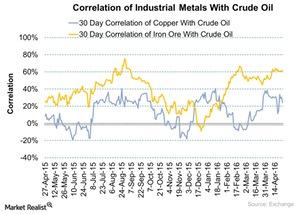

Analyzing the Correlation of Crude Oil and Industrial Metals

In the past year, US crude oil was more correlated with iron ore than copper. In August 2015, the correlation between crude oil and iron ore touched 75.5%.

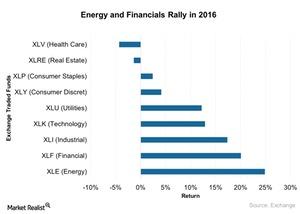

2016 US Sector Performance: Top Performers in Energy and Financials

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure.