Copper Stabilizes While Gold Trades near Two-Year High

Copper prices stabilized on Monday, July 4, amid expectations of stimulus from central banks.

Nov. 20 2020, Updated 3:28 p.m. ET

Copper stabilizes on Monday

Copper prices stabilized on Monday, July 4, amid expectations of stimulus from central banks. At 12:37 PM EDT on July 4, COMEX copper futures contracts for September delivery were trading at $2.22, a gain of 0.14%. The weaker dollar also supporting copper prices. On Friday, July 1, copper prices regained strength and ended the week with profits. Read Copper Regained Strength and Reversed on July 1 to learn how copper traded on July 1.

Market expects economic stimulus

Britain’s vote to leave the European Union has triggered fears about the stability of the global economy, and the market is looking towards central banks for stimulus. This has drastically decreased the probability of a US interest rate hike in the short term, and expectations of stimulus in China are growing. As China is the largest consumer of copper, economic stimulus would boost copper prices. In the last week, major copper producers Freeport-McMoRan (FCX), Rio Tinto (RIO), Glencore (GLNCY), and BHP Billiton (BHP) gained 12.0%, 14.0%, 9.1%, and 12.7%, respectively. The SPDR S&P Metals & Mining ETF (XME) and the PowerShares DB Base Metals ETF (DBB) gained ~12.2% and 5.4%, respectively.

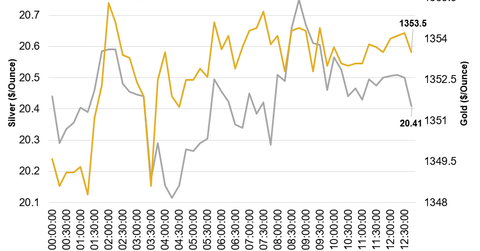

Gold and silver prices hover around two-year high

Gold prices surged to above a two-year high on Monday, July 4, whereas silver was trading near its two-year high. At 12:51 PM EDT, COMEX gold futures contracts for August delivery gained 1.1% to reach $1353.80 per ounce, the highest close since March 2014. Silver was trading 4.4% higher, at $20.44 per ounce, its highest close since the end of July 2014. Growing worries over economic health and decreased chances of an interest rate hike by the Fed boosted the demand for safe-haven assets such as gold. In the last week, precious metal producers Barrick Gold (ABX), Newmont Mining (NEM), Silver Wheaton (SLW), and Royal Gold (RGLD) gained 5.2%, 7.0%, 12.6% and 7.7%, respectively. The PowerShares DB Gold ETF (DGL) surged 2.0%.