AMLP Fell: Did It Outperform Other Energy ETFs?

The Alerian MLP ETF (AMLP) outperformed other energy ETFs from June 9–16, 2016. Falling crude oil has less of an impact on midstream companies.

June 17 2016, Published 9:28 a.m. ET

US crude oil fell

On June 16, 2016, US crude oil (USO) (USL) closed at $46.21. That’s 9.8% lower than its 2016 high of $51.23 on June 8, 2016. Since June 10, crude oil prices have been in a downtrend following the rise in the oil rig count again. Between June 10 and June 16, US crude oil futures have lost about 5.8%.

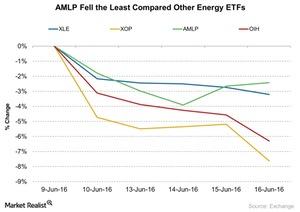

AMLP outperformed other energy ETFs

The Alerian MLP ETF (AMLP) outperformed other energy ETFs from June 9–16, 2016. Below are the other ETFs and their performances:

- The Energy Select Sector SPDR ETF (XLE) fell 3.2%.

- The Alerian MLP ETF (AMLP) fell 2.4%.

- The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) fell 7.6%.

- The VanEck Vectors Oil Services ETF (OIH) fell 6.3%.

The fall in the above ETFs started after the rise in oil rigs on June 10. AMLP fell the least. Falling crude oil has less of an impact on midstream companies—compared to other energy subindustries. Historically, XOP has a higher correlation to crude oil compared to other ETFs. XOP tracks crude oil closer than XLE because it has more upstream companies in its portfolio. So, XOP fell more than XLE. From June 9–16, crude oil futures fell 3.7%.

Below are XOP’s upstream energy companies and their weights in the ETF:

- Bill Barrett (BBG) 1.2%

- Continental Resources (CLR) 1.4%

- Triangle Petroleum (TPLM) 1.3%

- Denbury Resources (DNR) 1.4%

In the next part, we’ll see why the United States Natural Gas ETF (UNG) outperformed the United States Oil ETF (USO).