A Look at GM’s Stock Performance

In this part of our focus on the top 18 cheap S&P 500 stocks, we’ll discuss another six stocks: General Motors (GM), Ford Motor (F), Owens-Illinois (OI), The Goodyear Tire & Rubber Company (GT), Navient (NAVI), and Brighthouse Financial (BHF).

Dec. 27 2017, Published 8:13 a.m. ET

Overview

In this part of our focus on the top 18 cheap S&P 500 stocks, we’ll discuss another six stocks: General Motors (GM), Ford Motor (F), Owens-Illinois (OI), The Goodyear Tire & Rubber Company (GT), Navient (NAVI), and Brighthouse Financial (BHF).

Net sales

General Motors’ (GM) net sales revenue grew 9% in 2016 before falling 1% in 9M17 (the first nine months of 2017). Both GM Automotive and GM Financial drove growth in 2016. While GM North America supported growth in GM Automotive, GM Europe saw flat growth, and GM International Operations and GM South America offset it. US growth in GM Financial was offset by non-US regions. The fall in 9M17 was mainly due to decline in GM Automotive.

Diluted earnings per share

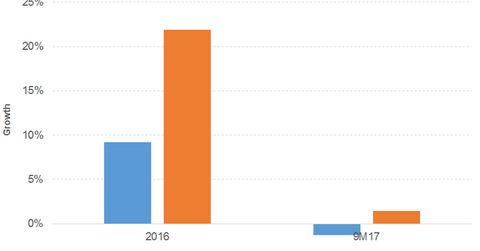

GM’s gross margin grew 25% in 2016 and 6% in 9M17. GM Financial’s interest, operating, and other expenses rose 7% and 15% in 2016 and 9M17, respectively. Its operating income grew 95% in 2016 before falling 9% in 9M17, and its net income grew 17% in 2016 before falling 3% in 9M17. Its diluted earnings per share grew 22% and 1% in 2016 and 9M17, respectively, enhanced by share buybacks. The company has been unable to generate positive free cash flow since 2014.

The First Trust NASDAQ Global Auto Index ETF (CARZ), which has exposure to GM, has a PE (price-to-earnings) ratio of 8.9x and a dividend yield of 2.1%. The First Trust NASDAQ Transportation ETF (FTXR) also has exposure to GM, and has a PE ratio of 13.1x and a dividend yield of 1.1%. In the next part, we’ll compare GM’s performance with that of peers and the S&P 500 (SPX-INDEX) (SPY), Dow Jones Industrial Average (DJIA-INDEX) (DIA), and NASDAQ Composite (COMP-INDEX) (ONEQ).