Navient Corp

Latest Navient Corp News and Updates

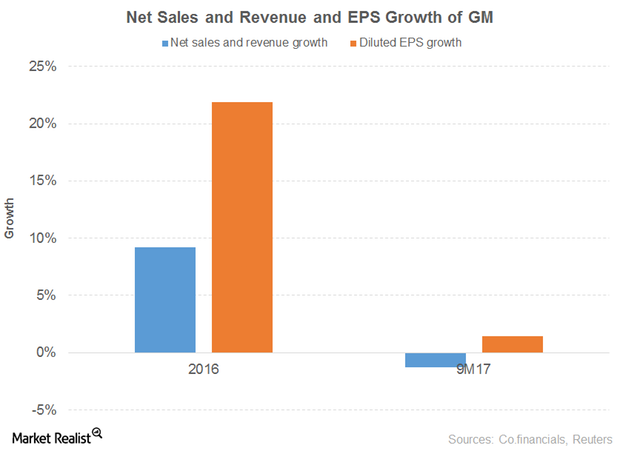

A Look at GM’s Stock Performance

In this part of our focus on the top 18 cheap S&P 500 stocks, we’ll discuss another six stocks: General Motors (GM), Ford Motor (F), Owens-Illinois (OI), The Goodyear Tire & Rubber Company (GT), Navient (NAVI), and Brighthouse Financial (BHF).

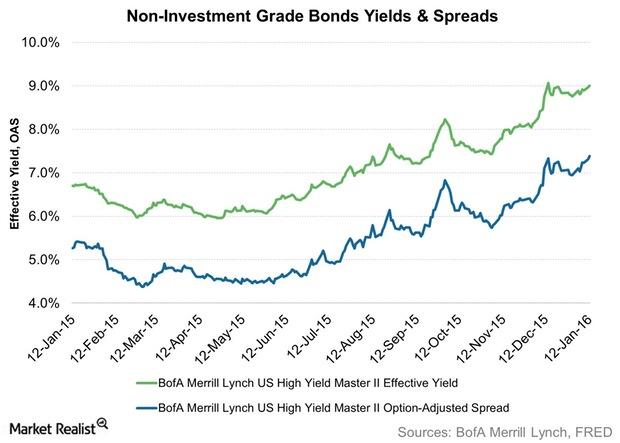

High-Yield Bonds and You in 2016

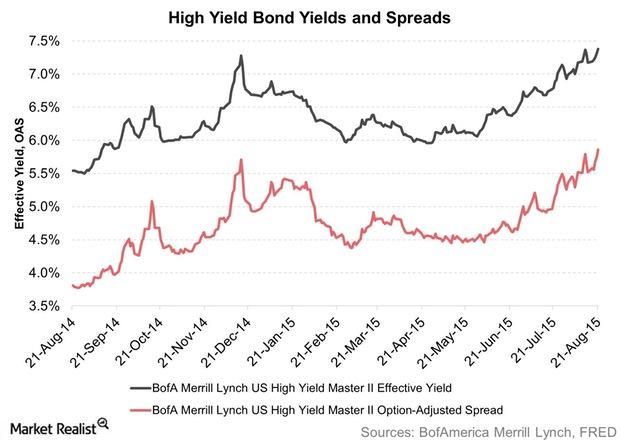

High-yield bonds, also known as Junk bonds, have an iffy repayment ability, even if they are at the higher end of the junk rating scale.

Widening High-Yield Bond Spreads: Opportunity or Threat?

Investors should note that high-yield bonds are risky securities to begin with. The add-on risk of widening spreads may not suit all types of investors.