The Lowe’s-Rona Transaction: Sizing Up the Potential Synergies

Lowe’s (LOW) expects the Rona (RON.TO) transaction to be accretive to its earnings per share or EPS from the very first year after the acquisition.

Nov. 20 2020, Updated 10:46 a.m. ET

Financial benefits flowing to Lowe’s from the Rona transaction

Lowe’s (LOW) expects the Rona (RON.TO) transaction to be accretive to its earnings per share or EPS from the very first year after the acquisition. Consensus analyst estimates have projected that Rona will earn adjusted EPS of $0.93 Canadian in the fiscal year ended December 31, 2015, on revenue and EBITDA of $4.2 billion Canadian and $256 million Canadian, respectively.

Lowe’s also believes it could double its operating profitability in Canada over the next five years post-acquisition. The retailer estimates that its Rona acquisition could increase sales (XLY) by $1 billion Canadian and enhance its profitability margins in Canada.

Potential synergies

The estimated synergies on the costs side include economies of scale in purchasing and supply chain functions and the elimination of public company reporting costs for Rona.

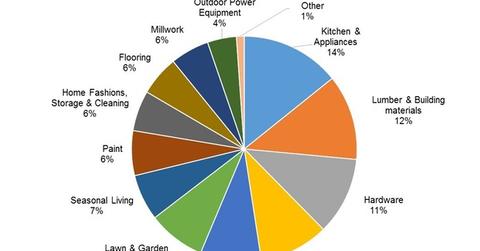

On the revenue side, Lowe’s plans to enhance merchandise at Rona stores to include appliances and more decor items, and also to make available its own private label brands at Rona. Kitchen & Appliances is Lowe’s largest selling merchandise category, accounting for 14% of its sales last fiscal year. Stanley Black and Decker (SWK), Samsung (SNNLF), Whirlpool (WHR), and General Electric (GE) are some of Lowe’s most prominent appliances suppliers.

Lowe’s also plans to leverage its omnichannel expertise and customer service initiatives to drive higher sales growth (IWB). Lowe’s, along with rivals like Home Depot (HD), and Williams-Sonoma (WSM), is increasingly pushing for more digital sales. Online home furnishing retailer Wayfair (W) offers over 5,000 products on its Canadian website.

Concessions

Besides the agreement to operate Rona’s different store banners, as we discussed in the last article of this series, Lowe’s has also made several other concessions as part of the acquisition agreement. These include:

- moving its Canada headquarters to Boucherville, Quebec, where Rona is presently headquartered

- providing enhanced distribution services to independent dealers

- continuing to employ most existing staff, including key executives, at Rona (Sylvain Prud’homme, president of Lowe’s Canada, will head the combined outfit post-acquisition)

- continuing Rona’s local purchasing strategies and maintaining relationships with key local vendors and manufacturers

Margin headwinds

Presently, Lowe’s doesn’t disclose revenue and profitability numbers for its international operations. However, Rona’s profitability margins are far lower than Lowe’s overall and are likely to prove dilutive to Lowe’s consolidated results—at least in the near term.

Dividend aristocrat LOW makes up 0.49% of the portfolio holdings in the SPDR S&P Dividend ETF (SDY).