Diversify Broadly and Consider Alternative Investments

Rising correlation across asset classes is a sticky problem that investors face while investing in today’s markets.

Nov. 20 2020, Updated 3:20 p.m. ET

4. Be flexible and diversify broadly. While no number of holdings will ever eliminate investment risk, or prevent losses, Mr. Stattman is a firm believer that broader is better. The Global Allocation Fund holds 700+ positions across 40 countries and 30 currency types. The key is not simply to hold as many names as possible but to spread out your risk factors. For example, there are some bonds that can behave like stocks (e.g., high yield) and some stocks that can behave like bonds (e.g., income producers like utilities). Having multiple “masqueraders” (or more precisely and technically, having many highly correlated assets) will not amount to a diversified portfolio.

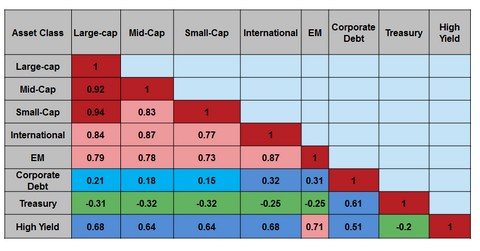

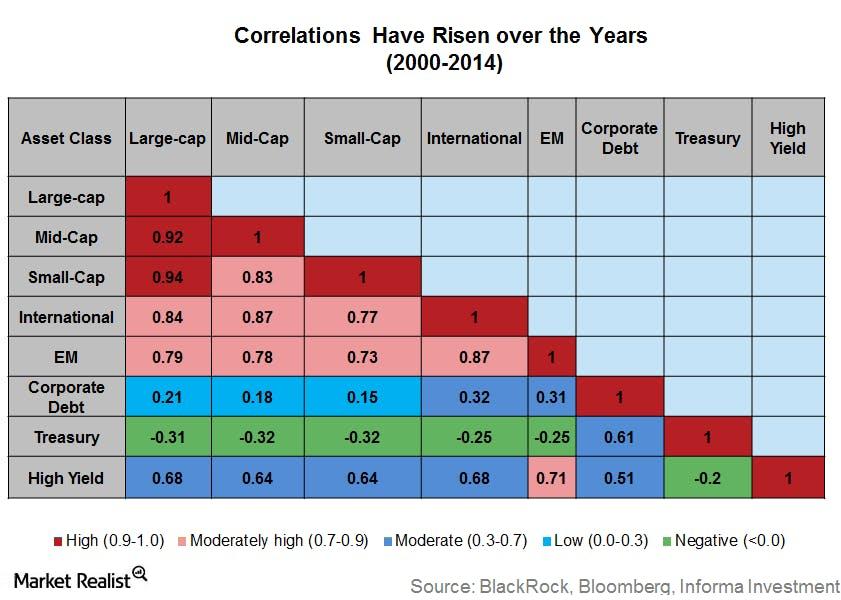

Market Realist – Rising correlation across asset classes is a sticky problem that investors face while investing in today’s markets. The correlations between traditional asset classes have risen as financial markets around the world have become more integrated. The above graph shows the correlations between traditional asset classes from 2000 to 2014. The correlations of international equities and emerging markets with large-cap US equities have risen to 0.84 and 0.79, respectively. This makes it more challenging to own a well balanced and diversified portfolio. Investors can consider alternative investments to avail of additional diversification benefits.

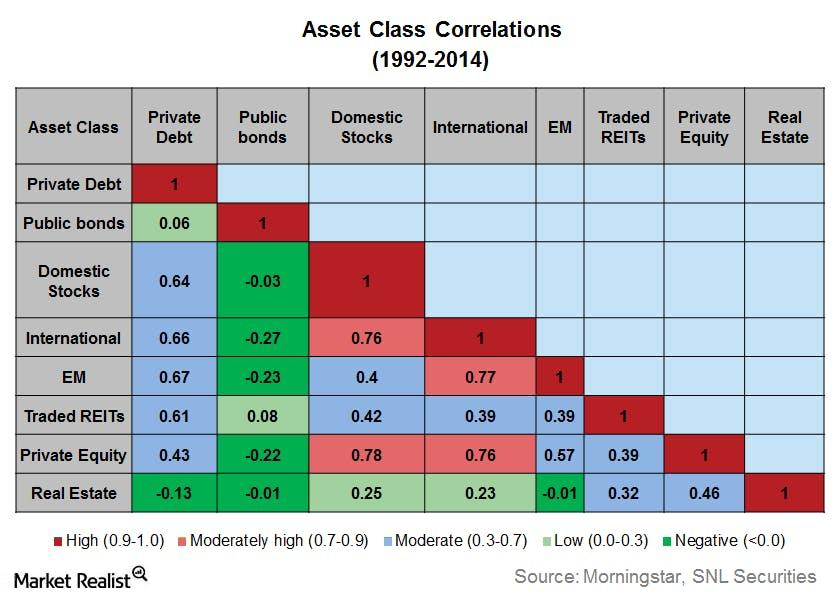

The above graph shows the correlation of various asset classes from 1992 to 2014. As you can see, alternatives like REITs (XLRE) and real estate (IYR) have less correlation with domestic US stocks (VTI) than other asset classes like emerging market equities (VWO) (EEM) and international equities (ACWI).

Some classes of alternative assets can also prove to be effective hedges against inflation. These include commodities like gold (IAU) (GLD) and silver (SLV) as well as infrastructure investments that provide low but stable returns.

Alternative investments often perform better than traditional asset classes in periods of financial stress, effectively smoothing out the returns from a portfolio. Thus, alternative investments could provide the much-needed diversification benefits in a portfolio. However, investors should be mindful of the volatility that alternative investing can bring to a portfolio. For instance, traded REITs (VNQ) have historically been a volatile asset class. A portfolio should not be skewed in favor of any asset class, but should be well balanced.

You can vastly limit your downside risks by diversifying your portfolio effectively. Understanding investor psychological biases and overcoming them is key while investing for a balanced portfolio.

Read our series on How You Can Overcome 3 Bad Investing Habits to learn more about overcoming investor biases.