Real Estate Select Sector SPDR®

Latest Real Estate Select Sector SPDR® News and Updates

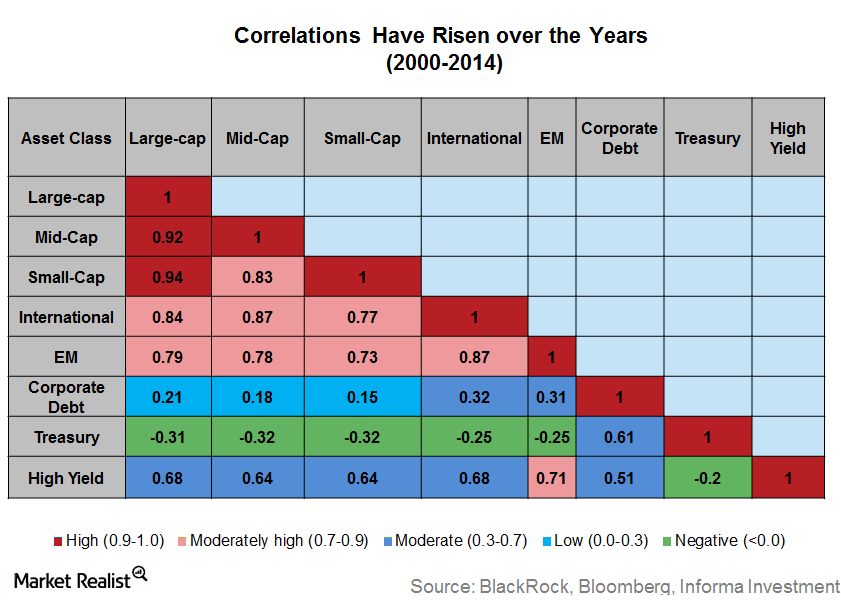

Diversify Broadly and Consider Alternative Investments

Rising correlation across asset classes is a sticky problem that investors face while investing in today’s markets.

Bill Gross: Top Stock Picks with High Dividend Yields

On October 18, CNBC reported Bill Gross top picks. His top stock picks were Annaly Capital (NLY), Invesco (IVZ) and Allergan (AGN).

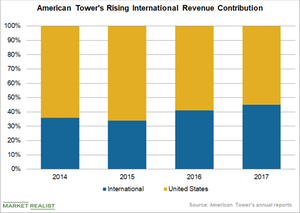

What American Tower’s Global Expansion Strategy Indicates

American Tower’s (AMT) global expansion strategy, which includes acquisitions and joint ventures in several countries (mainly in developing nations), is likely to continue supporting its top line.

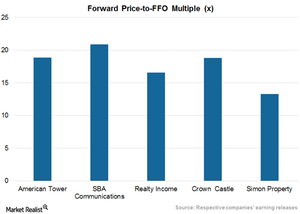

American Tower Is Trading at High Multiples amid Global Expansion

American Tower (AMT) is currently trading at a trailing-12-month price-to-FFO ratio of 20.2x.

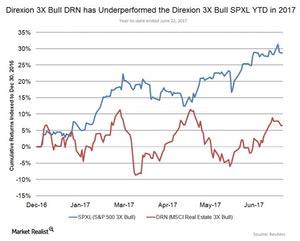

Will the Real Estate Sector Shine Thrive this Summer?

Another important summer activity is shopping for a new home. Realtors often talk of curb appeal, and there’s no better time than summer.