Comp: A Look at Gold Miners’ 2Q15 Production Profile

Gold miners’ (GDX) production profile is very important for investors. According to the WGC, gold mine production rose by 3% YoY to 786.6 tons in 2Q15.

Oct. 9 2015, Updated 7:05 p.m. ET

Production profile

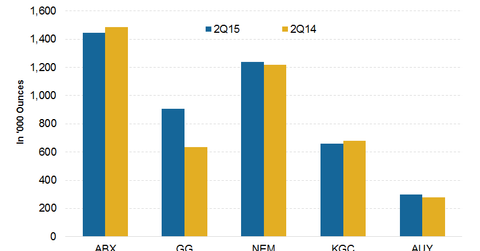

Gold miners’ (GDX) production profile is very important for investors. According to the WGC (World Gold Council), gold mine production rose by 3% YoY (year-over-year) to 786.6 tons in 2Q15. The growth was scattered across the globe. Newmont’s Batu Hijau mine in Indonesia had the largest contribution to the volume growth. This was mainly because the mine entered a high-grade area. Barrick Gold’s (ABX) Goldstrike mine and Newmont’s Twin Creeks mine also made a significant contribution to the production growth YoY.

Barrick’s asset sales caused production to fall

In 2Q15, Barrick Gold’s gold production came in at 1.5 million ounces. This is a fall of 2.70% YoY. However, the fall was mainly due to the non-core asset sales by Barrick.

Newmont Mining (NEM), reported a rise of 0.2 million ounces or 1.60% YoY to 1.24 million ounces in 2Q15. Although Newmont also sold some assets during the year, the fall was offset by its Batu Hijau and Tanami mines.

Goldcorp’s record quarterly production

Goldcorp (GG) reported record quarterly gold production of 908,000 ounces in 2Q15. This was due to the outstanding performance of its Peñasquito mine. This is a solid 40% growth YoY and 25% growth quarter-over-quarter.

Kinross Gold’s (KGC) 2Q15 production was 660,898 ounces of gold—a fall of 2.80% YoY. The lower production was mainly due to heavy rains in March at its Maricunga mine and lower mill throughput and recoveries at its other mines.

Yamana Gold (AUY) reported 2Q15 production of 298,818 ounces. This is 7% higher YoY. However, it was slightly lower than the market expectations. Lower production was mainly driven by lower-than-expected grades.

Gold-backed ETFs like the SPDR Gold Trust ETF (GLD) and the iShares Gold Trust (IAU) are another way for investors to get exposure to gold prices.

While it’s important to understand the latest production trends, it’s more important to look at companies’ outlook for production going forward. We’ll discuss this next.