How Can Changing Demographics Impact Investors?

Changing demographics impact investors in many ways. The demand for bonds could increase, putting downward pressure on yields.

May 4 2021, Updated 10:31 a.m. ET

It’s also important to remember that in regions that are fighting major structural headwinds there will be a greater degree of policy risk, and those risks can create market distortions. Short-term distortion influences present opportunities, but long-term distortion makes investing more problematic.

The impact of these various demographic trends is likely to be that inflation will be secularly lower than it has been in the past, and attempts by central banks to raise inflation may ultimately be challenged. In fact, central bank mandates that are focused solely on driving inflation higher to “target levels,” or those that remain too “patient” due to muted inflation on the road to policy normalization, run the risk of creating market distortions.

How will changing demographics impact investors?

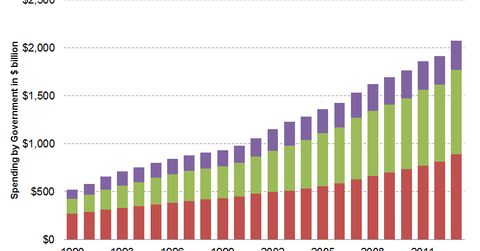

Market Realist: Entitlement spending has been steadily increasing over the years, as can be seen in the previous graph. An aging population is likely to put added pressure on the government’s finances.

The aging population would put pressure on budgetary and fiscal policies going forward. An increasing number of senior citizens is likely to mean increased Social Security and entitlement spending. The graph below shows the Congressional Budget Office’s projections for the items that would lead to an increase in federal spending until 2024.

Changing demographics impact investors in many ways. As discussed in previous parts of this series, the demand for bonds (TLT) could increase, putting downward pressure on yields. Equity multiples (IVV) could stay muted in the long term as the older, risk-averse age group avoids risky asset classes.

Healthcare sector

The healthcare sector (XLV) could witness phenomenal growth in the future. Already, the sector has seen an upsurge in M&A activity. According to data from Dealogic, the value of M&A transactions in the healthcare sector was a whopping $293.6 billion from 537 deals in the first two quarters of the year.

The legality of the Affordable Care Act has been recognized by the Supreme Court, a move that could drive a slew of M&A transactions as companies scramble to consolidate and improve margins. Aetna (AET) has announced the acquisition of Humana (HUM) in a recent $34 billion deal. Anthem (WLP) has also has its sights trained on Cigna (CI), although a deal has not gone through yet. The surge in healthcare (IHF) and biotech stocks (IBB) is likely to be sustained as the population continues to age and the demand for healthcare services rises.

Diversification

Investors should also look to diversify by investing in younger nations. Long-term investors can seek opportunities in emerging markets with younger populations like India (EPI), Brazil (EWZ), Indonesia, Mexico, and the Philippines.

To understand the other demographic changes that could affect your portfolio, read our series on 3 big picture shifts you should pay attention to.