Johnson & Johnson Invested in Research and Development

For a big pharma company like Johnson & Johnson (JNJ), research and development plays a vital role in maintaining a healthy revenue stream.

March 17 2015, Updated 1:06 p.m. ET

Research and development

For a big pharma company like Johnson & Johnson (JNJ), research and development, or R&D, plays a vital role in maintaining a healthy revenue stream. These expenses relate to the process of discovering, testing, and developing new products and improving the existing range of products. These expenses also ensure product efficacy and regulatory compliances before the launch.

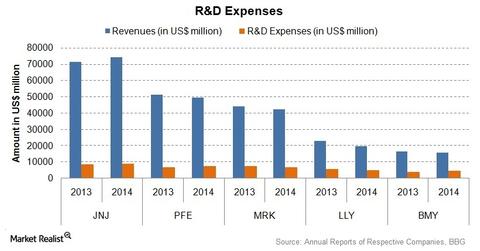

The above chart compares the R&D expenses for Johnson & Johnson, Pfizer (PFE), Merck & Co. (MRK), Eli Lily and Company (LLY), and Bristol-Myers Squibb Co. (BMY). As a percentage of sales, the R&D expenses for Johnson & Johnson were around 11.4% in 2014. For the Pharmaceuticals segment, the R&D expenses were about 8.3%. For the Consumer Products segment, the expenses were nearly 0.85%. For the Medical Devices and Diagnostics segment, the expenses were about 2.2%.

The company has its own R&D centers strategically located in Asia-Pacific, Boston, California, and London. It offer entrepreneurs quick access to all of the resources for the Johnson & Johnson Family of Companies.

The company invests in R&D to ensure the delivery of high quality and innovative products. It develops new drugs through R&D to be ready with new products and patents by the time existing patents expire. This is a constant process. As a result, R&D is important for any company’s growth. The in-process R&D, or IPR&D, refers to recently discontinued or delayed development projects.

For each segment, the contribution of R&D as of December 2014 is listed below:

Pharmaceuticals segment

- ten major new product filings and over 25 brand line extensions between 2013 and 2017

- 11 new products already launched between 2009 and 2013

- nearly 50 compounds in early development

- nearly 100 ongoing discovery projects

Medical Devices and Diagnostics segment

- 30 major new product filings expected between 2014 and 2016

Consumer Products segment

- 20 key product launches expected globally in 2015

Patent expiry

Johnson & Johnson lost exclusivity on two patented drugs in 2013—Aciphex and Concerta. Velcade is a cancer treatment drug. It lost exclusivity in 2014. One of the key drugs is Remicade. It’s for autoimmune diseases. It’s expected to lose exclusivity in the European Union in 2015. It’s expected to lose exclusivity in the US in 2018.

Teva Pharmaceutical Industries (TEVA) lost exclusivity on Copaxone. AstraZeneca (AZN) lost exclusivity on Nexium. Merck & Co. (MRK) lost exclusivity on Nasonex. Eli Lily and Company (LLY) lost exclusivity on Evista in 2014. Johnson & Johnson forms 8.23% of the total assets of the iShares US Pharmaceuticals (IHE) and 10.54% of the SPDR Health Care Select Sector ETF (XLV).