CalPERS raises position in Staples

Staples began discussions to acquire Office Depot in September 2014. Staples will acquire all outstanding Office Depot shares in the $6.3 billion deal.

Dec. 4 2020, Updated 10:53 a.m. ET

CalPERS boosts position in Staples

CalPERS added to its stake in Staples (SPLS), that currently accounts for 0.13% of the pension fund’s total portfolio for the quarter ended in December 2014. It owns 5,533,156 shares in Staples, up from 4,094,091 shares at the end of the previous quarter filing.

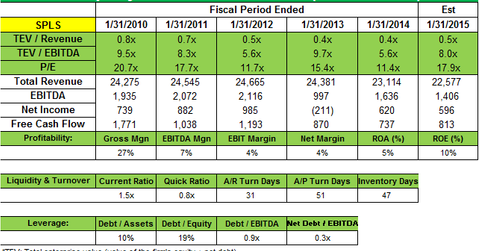

Overview of Staples

Staples is a provider of products and services that serve the needs of business customers and consumers. Its products include:

- office supplies

- technology

- facilities and breakroom supplies

- furniture

- basic safety and medical supplies

- copy and print services

Headquartered outside of Boston, Staples operates throughout North and South America, Europe, Asia, Australia, and New Zealand. It has three major divisions: North American Stores and Online, North American Commercial, and International Operations.

Staples merger with Office Depot

Staples, a market leader in office supplies, and Office Depot (ODP) recently announced that the companies entered into a definitive agreement under which Staples will acquire all of the outstanding shares of Office Depot. The transaction values Office Depot at $11.00 per share, which represents a premium of 44% over the closing price of Office Depot shares as of February 2, 2015. The deal is valued at $6.3 billion.

Staples noted it began discussions to acquire Office Depot in September 2014. It said the deal will generate “at least $1 billion of synergies as it aggressively reduces global expenses and optimizes its retail footprint.”

Merger push initiated by Starboard Value

The merger was pushed by activist hedge fund Starboard Value, which owns stakes in both companies. Market Realist noted in December that despite their size and large retail footprint, both companies have been plagued by falling revenues in recent years. Sales from office supplies—their core product category—have been declining, partly due to competitors denting the market share. This decline is also due to changes in technology and reduced corporate requirements. As a result, their share prices suffered in recent years.

Major competitors for Staples and Office Depot include Walmart (WMT), Tesco (TESO), Target (TGT), Costco (COST), Best Buy (BBY), Apple (AAPL), Amazon (AMZN), and FedEx Office (FDX). Due to differences in the business models, some of these firms are able to undercut pricing—compared to niche retailers like Staples and Office Depot.

CalPERS holdings updates in 4Q14

The pension fund added new positions in Dorian LPG Ltd. (LPG), CDK Global (CDK), Keysight Technologies (KEYS), and LM Ericsson Telephone Company (ERIC). The fund exited a stake in Medtronic Plc (MDT), Taiwan Semiconductor Manufacturing (TSM), and Equinix (EQIX). It enhanced its positions in Kinder Morgan (KMI) and Staples (SPLS).