Equinix Inc

Latest Equinix Inc News and Updates

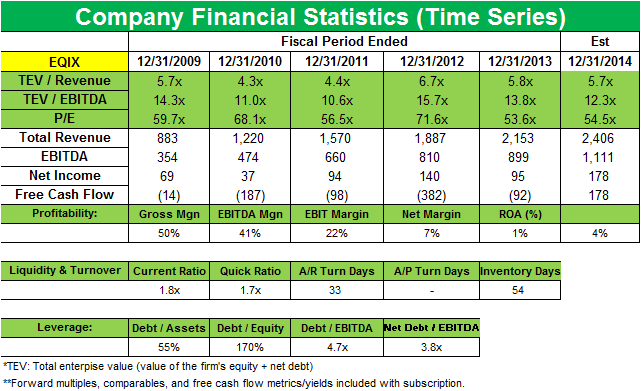

JANA sells stake in Equinix

JANA Partners sold a significant stake in Equinix (EQIX) during the fourth quarter. The position accounted for 3.38% of the fund’s third-quarter portfolio.

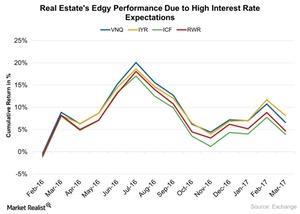

The Real Estate Reaction: Gauging the Impact of the Fed’s Rate Hikes

The rising interest rate is expected to boost the economy in the long run, but it could severely impact sectors like real estate.

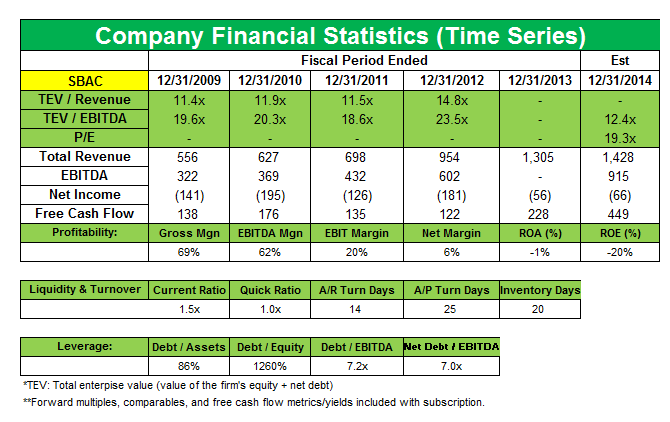

Why did Lone Pine Capital buy a stake in SBA Communications?

SBA Communications Corporation is a 2.11% position initiated by Lone Pine Capital in 4Q 2013.

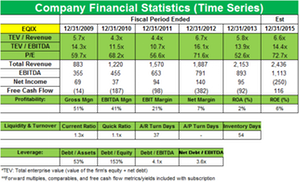

Stephen Mandel’s Lone Pine Capital buys a new position in Equinix

Lone Pine initiated a new position in Equinix (EQIX) last quarter that accounts for 1.81% of the fund’s total 1Q portfolio. Lone Pine had exited the position in 4Q 2013 and restarted it last quarter.

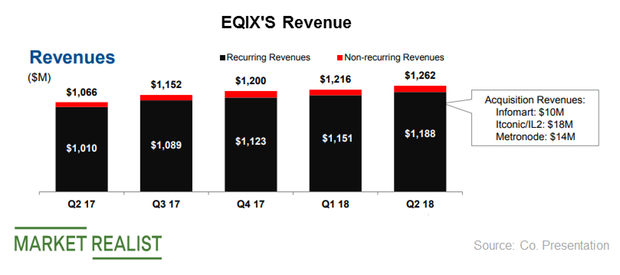

Equinix’s Latest Performance and Future Projections

Equinix’s (EQIX) revenue rose at a four-year CAGR (compound annual growth rate) of 19% to $4.4 billion in 2017.

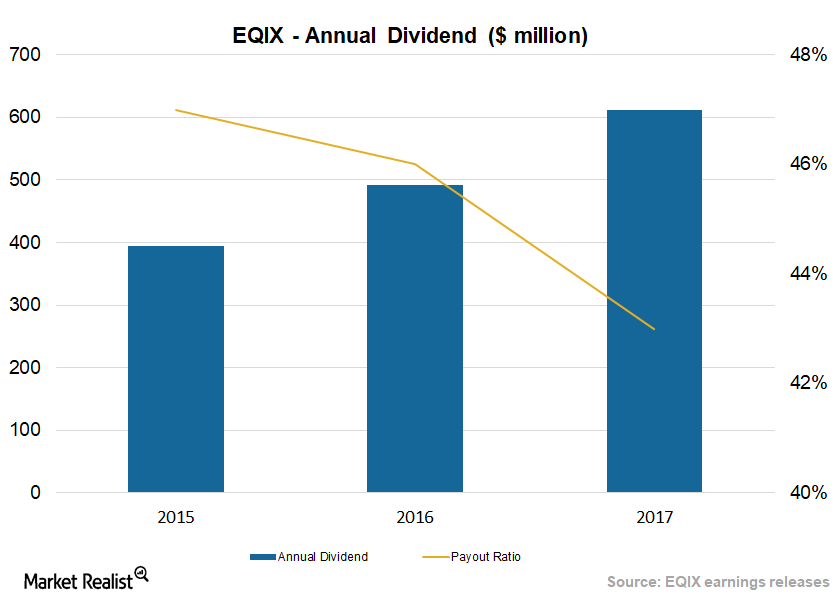

How Equinix Rewards Its Shareholders

Equinix (EQIX) announced a dividend of $2.00 per share for 3Q17, leading to a total of $8.00 for 2017 and up from $7.00 in 2016.

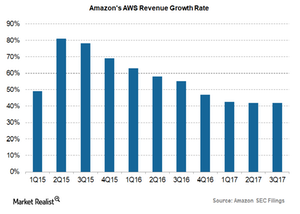

Why Amazon Is Partnering with Equinix

Amazon’s (AMZN) cloud services unit, Amazon Web Services (or AWS), and Equinix (EQIX) have strengthened their partnership.

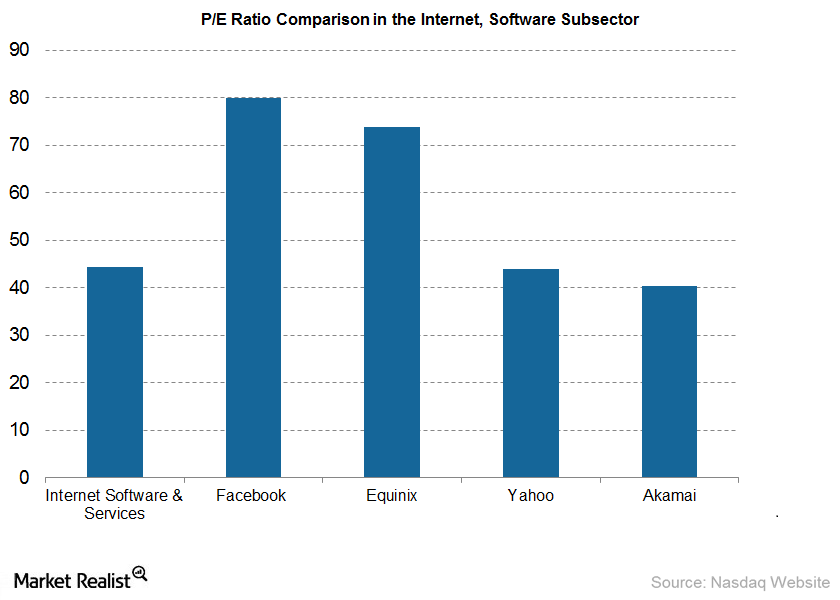

What Does Facebook’s High Price-to-Earnings Ratio in May Tell Us?

In May 2012, Facebook’s stock price was $38, and its PE ratio was 80.0 x. The ratio reached an all-time high of 7,930x, when net income dropped to $53 million that year.