Office Depot Inc

Latest Office Depot Inc News and Updates

Why Online Sales Are A Competitive Advantage For Staples

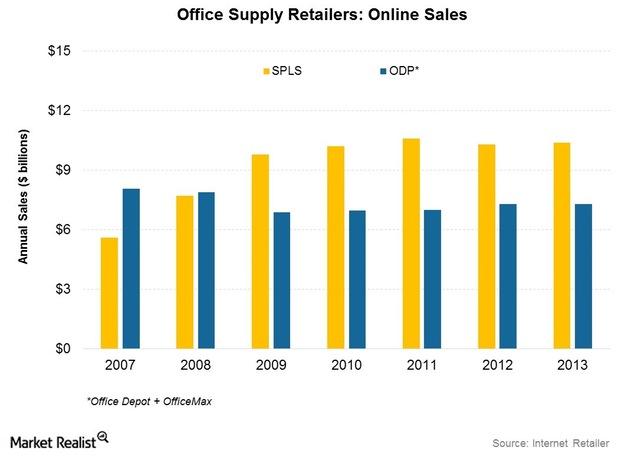

The growth in ODP and OMX’s combined sales fell—compared to Staples. They were ~143% of SPLS’s sales in 2007. This is just over $8 billion. That fell to $7.3 billion in 2013.

Office Supplies Retail: Regulation, Competition, And Consolidation

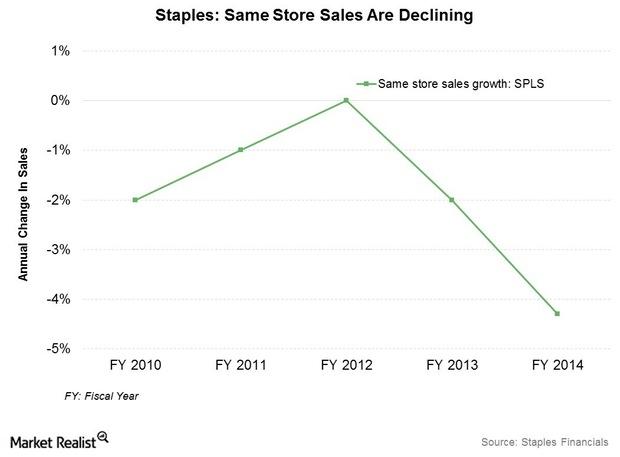

There aren’t many large brick-and-mortar players left in the market. The industry faced stiff competition from online retailers like Amazon (AMZN).

The Relationship between the Retail Industry and the US Economy

When we compare the S&P 500 (SPX) with the SPDR S&P Retail ETF (XRT), the retail ETF has beaten the broad market index on a trailing one-year basis.

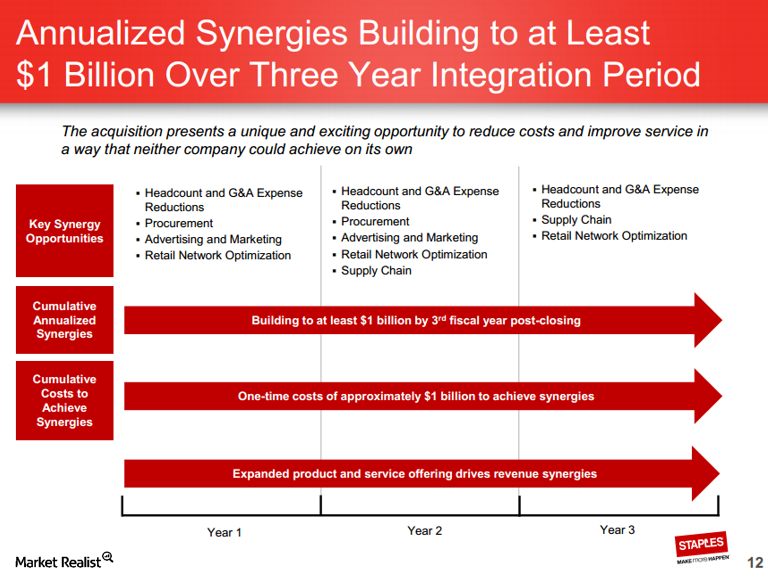

The Office Depot–Staples merger is about cost savings

Staples expects to spend $1 billion up front in order to achieve $1 billion in annual synergies—usually meaning reducing workforce—beginning in year three.